Most folks buy closed-end funds for one reason: big yields!

But that’s not the only reason—and depending on your situation, it may not even the best reason for you, as I’ll show you shortly. (I’ll also reveal 3 tricky, but easily avoidable, blunders many folks make with CEFs).

First, there’s no doubt CEF payouts are legendary.

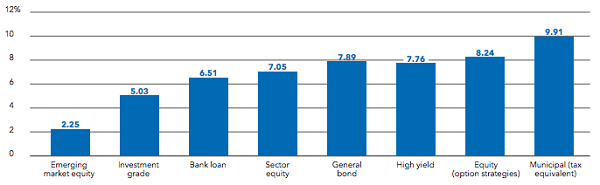

According to BlackRock’s latest quarterly update, dividend yields range from an average of 2.25% in the lowest-paying CEF sector (emerging market equity) to 9.9% in the highest paying (municipal-bond funds). (The muni-bond fund yield is on a tax-equivalent basis and based on a 43.4% tax rate, as munis are exempt from federal income tax):

A Rich Hunting Ground for Yield Fans …

…

Read more

Recent Comments