I hope you are taking care of yourself, and your family. This is a good time to hunker down, both in life and in our investing strategy. Brighter days are ahead—let’s make sure we get there with ourselves and our portfolios relatively intact.

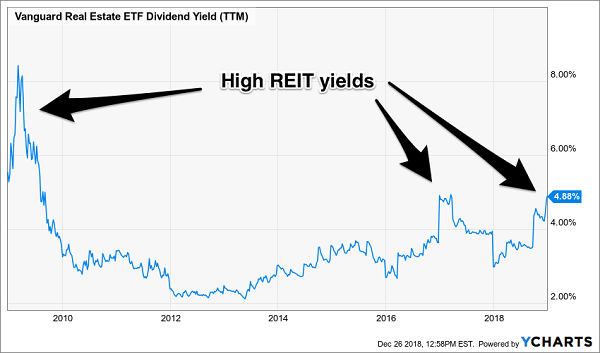

On the other side of this pandemic and shutdown, we may eventually be presented with a “March 2009” type of buying opportunity. Big yields for dimes on the dollar. When the time is right, we’ll load up our income portfolios with these bargains and resume our usual light banter in this weekly missive.

Unfortunately, I don’t think we’re on the other side of this just yet.… Read more

Recent Comments