My friends and I couldn’t have been more excited about our college commencement speaker. Fresh off an electrifying cameo in the 2003 comedy movie Old School, James Carville’s next act was Cornell University.

At 21 years old, we had no idea what Carville actually did for a living. (Answer: Political consultant.) And though he was an engaging and entertaining speaker, I don’t remember a single word the “Ragin’ Cajun” said. Too bad, because he has had some major wisdom to impart.

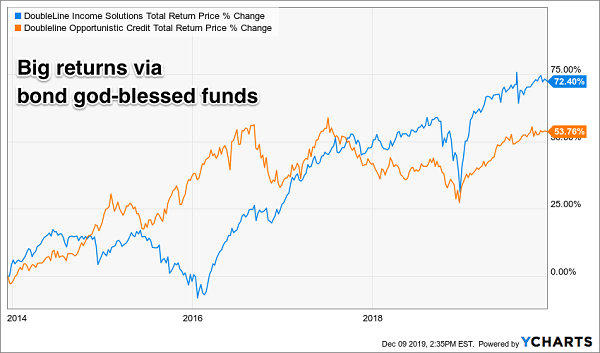

Ten years earlier, Carville made an observation that is more prescient now than ever. After watching bond investors rebuff President Clinton’s economic stimulus proposals because they demanded a higher interest rate for US Treasuries, Carville coined this gem:

“I used to think that if there was reincarnation, I wanted to come back as a president or the pope or as a .400 baseball hitter.

Recent Comments