Eric Ervin was making his wealthy client so much money that he suggested: “Hey, why don’t you just quit your job?”

The investor saw the opportunity to scale Eric’s “secret strategy” – and he wanted to help fund a new venture to bring this brilliance to the financial masses!

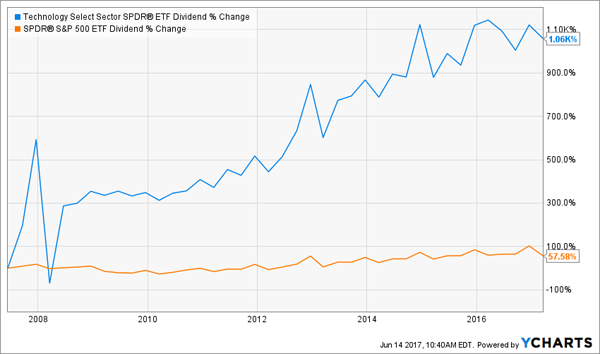

Both guys knew the power of dividend growth investing. But Eric’s second-level insight is what made them both a boatload of cash. He figured out a way to bet purely on the higher payouts – as close to a “sure thing” as you’ll ever see in stocks. Here’s what I mean.

Blue chip stocks tend to raise their dividends every year.… Read more

Recent Comments