Today I’m going to show you how to get a livable income stream from a $300,000 nest egg—while growing your savings at the same time.

Sounds impossible, right?

Wrong.

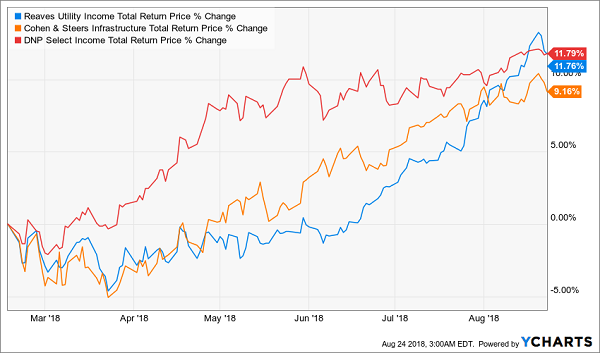

What’s more, we’re going to pull it off using just six funds. When we’re done, we’ll end up with a simple, diversified portfolio that throws off an amazing, steady 10.4% dividend yield—more than five times the S&P 500 average!

And if you’re worried that this outsized yield could come at the cost of a weak total return, don’t be, because these funds have delivered 12% per year over the past decade.… Read more

Recent Comments