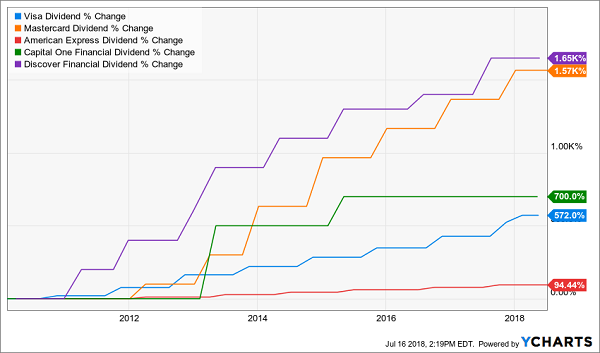

Ignore the doomsayers: 2019 is setting up to be a strong year for equities—and a great year for dividend investors like us.

I know this might surprise you, so let’s break it down. Further on I’ll give you 5 funds (with dividends up to 11.5%!) that are flashing buy signals you can’t afford to ignore.

So why am I so bullish on the year ahead?

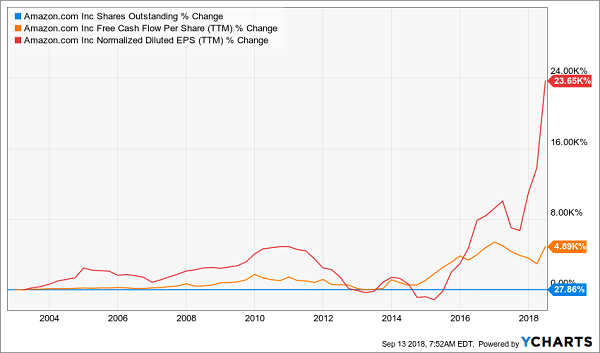

Thanks to the record-breaking profit growth we’ve seen in 2018, along with continued steady gains in employment and wages, there’s little reason to believe next year will bring the big downturn everyone’s worrying about. Instead, the Fed’s prudent scaling back of interest-rate hikes should fuel more growth.… Read more

Recent Comments