Collecting dividends is fun. Doubling our money is even better.

From time to time, Mr. and Ms. Market will present us with a deal that includes payouts plus price upside. I’m talking about 50% to 100% returns from secure dividend payers.

These “dividend doubles” require a catalyst. Some event that, if it unfolds, would launch profits—and the firm’s stock price!

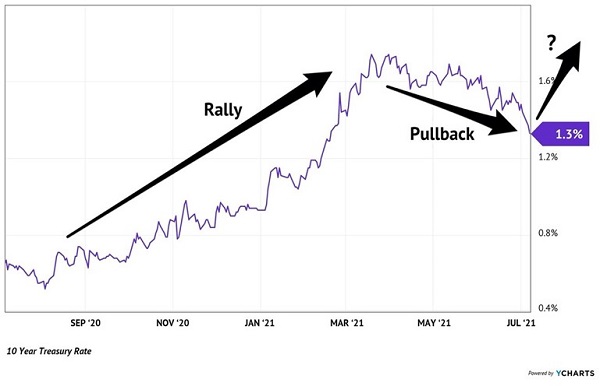

Higher interest rates are a compelling “catalyst bet” today. The 10-year Treasury yield tripled between August and April. We noted a few months back that the rate move was due for a breather, and that’s exactly what has unfolded with the benchmark rate briefly edging below 1.3% last week:

Time to “Buy the Dip” in Interest Rates?

Three short months ago, the entire financial world was betting on rising interest rates. They were collectively bearish on Treasuries and shorted them. But bonds can act as crazy as meme stocks when trades become too one-sided. Bond bears have been squeezed from their holdings as the prices of bonds have risen and rates have fallen.

Is the squeeze almost over? It looks like a compelling time to bet that it is.

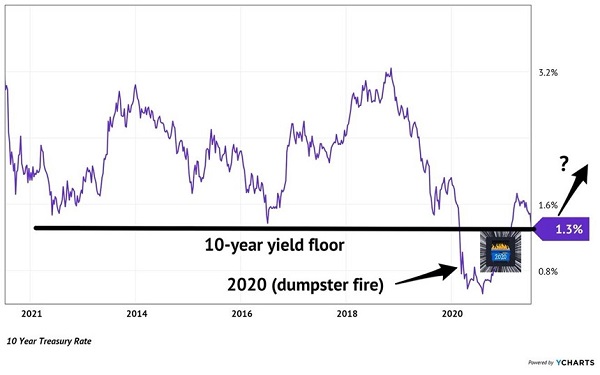

Exactly five years ago, the 10-year yield bottomed at these levels. For the past decade, in fact, 1.3% served as a reliable floor. Last year was the exception, but hey, when wasn’t last year the exception?

My bet is that the floor holds, and we see a bounce in yields:

A Likely Place for a Rate Bounce

And my favorite way to play this pullback is to buy cheap bank shares.

As the 10-year rate emerged from its own 2020 lockdown, the spread between the long and short end of the interest rate curve increased to something from nothing. Remember, the Federal Reserve has committed itself to keeping short-term rates low for a long time. It is just now only “talking about talking about” raising those rates.

A spread of something has been a boon for bank profits. Their borrowing costs (tied to short-term rates) are staying low while their lending profits (tied to long-term rates) rise.

Banks are making money at current levels. But I believe a 2%+ 10-year yield is likely. This would represent a 50% gain and is the type of “low downside, high upside” play we like in a dividend double catalyst.

Basic investors may read this, close their eyes and buy something like the Financial Select Sector SPDR Fund ETF (XLF). This bellwether ETF has $40 billion in assets parked in the big banks and insurers like Berkshire Hathaway (BRK.B), JPMorgan Chase (JPM) and Bank of America (BAC).

XLF yields 1.6%. It certainly has upside as rates turn around. But I don’t think it’s going to get us a 100% return.

If we want more dividend for our dollar—plus a potential double—then we need to look at small banks as the pure play on the rising rate trend.

In recent years I’ve moved most of my banking business to a small local bank that actually calls me on the phone. (Shout out to my crew at Five Star Bancorp (FSBC)—congrats on your recent IPO!)

Five Star just declared its first dividend of $0.15 per share. It is much easier to decipher Five Star’s balance sheet than B of A’s. Perhaps in the years ahead, after a track record of dividend growth, we’ll consider Five Star for inclusion in our elite Hidden Yields portfolio.

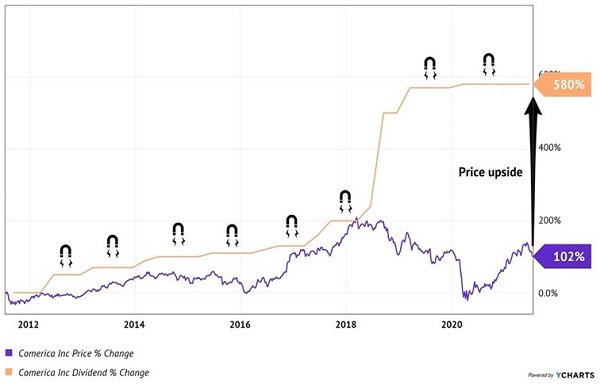

For now, we’re going to focus on stocks that have an excellent dividend track record. Let’s take Comerica (CMA), which has rewarded investors with 580% dividend growth over the past decade:

As profits improve with higher rates, management is likely to continue showering shareholders with raises. CMA’s share price is “due” to move higher with its dividend. Its price action during the first half of the year was a sneak preview of how the stock might behave if the 10-year peeks its head north of 2%.

The stock’s current 3.9% yield—which puts our ETF friend to shame—is just a starting point. Management has bought back 20% of the bank’s outstanding shares over the past five years. This helps every important metric on a “per share” basis, such as earnings, cash flow and of course the dividend itself.

Comerica is exactly the type of “recession-proof” stock that we focus on in my Hidden Yields research service. We buy dividend stocks that can easily double, thanks to underappreciated catalysts such as higher interest rates, profits and a dividend “magnet” that is due to pull the share price higher.

Whether it’s a bull market or a bear, we honestly don’t care. Worse case, these dividend doubles “only” return 15% per year, every single year. Click here and I’ll share my favorite 7 Hidden Yield stocks with you today.

Recent Comments