Your next Amazon.com box could be fueling a dividend—and stock price.

Talk about delivery-powered dividend growth! In the US, 3 billion e-commerce packages were delivered in 2020. And its not just Amazon (AMZN).

Brick-and-mortar retailers have finally realized that they must answer Amazon with convenient deliveries. Smart retailers such as Walmart (WMT) and Williams-Sonoma (WSM) have figured out that “omni-channel” (in-store and online) is the future.

They’re the types of companies that will survive the “great reset.”

E-commerce swallowed brick-and-mortar market share over the past decade, making up just 6.4% of retail sales in 2010, but a whopping 15.8% in 2019. Then came the lockdowns, and U.S. e-commerce sales spiked 31.7% year-over-year in 2020. Internet retail ballooned to 21.3% of overall sales.

There’s no stopping this trend. From research firm eMarketer:

“We forecast U.S. retail ecommerce sales will grow 13.7%, reaching $908.73 billion in 2021. Prior to the pandemic, we expected sales would grow just 12.8%.”

“How much will global retail ecommerce sales rise in 2021? Following a 25.7% surge in 2020, to $4.213 trillion, we expect retail ecommerce sales worldwide to climb a further 16.8% this year, to $4.921 trillion.”

This is great news for my favorite real estate investment trusts (REITs)—those that own warehouses. I’ve had a soft spot for distribution centers ever since my college internship in Mechanicsburg, PA for Johnson & Johnson (JNJ). Where the 81 and 83 met, 19-year-old me scurried around, learning a lot about logistics.

E-commerce hadn’t yet taken over the world. Today, companies are increasingly looking to these types of logistics facilities to manage inventory and distribute their goods.

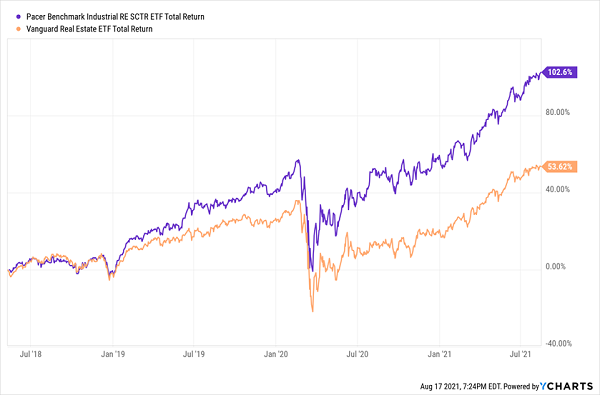

This megatrend has turned industrial REITs into unlikely rock stars of the income investment world. While it hasn’t been around for long, consider the success of the niche Pacer Benchmark Industrial Real Estate SCTR ETF (INDS) versus the broader real estate community over the past few years.

The Industrial-Focused INDS Has Roughly Doubled Up the VNQ

And as corporate results keep rolling in this year, there’s just no reason to bet against the space.

“(Recent earnings) continue to reinforce our bullish view and sector Overweight recommendation on the industrial REIT sector,” Raymond James analysts said in a late July note. “Supply and demand largely remain in balance across most of the country’s industrial submarkets (if anything, it appears as though the U.S. will again report that 2021 demand outpaces supply by more than [20 million square feet]) and continue to set the stage for strong annual growth in market rents, robust increases upon lease expiration/renewal, and annual rent bumps generally at or above 3%.”

The kicker? “We believe fundamentals are unlikely to change materially over the course of the next 2-3 years.”

So the stage is clearly set for industrial REITs to keep up their frantic pace, and with that should come some torrid dividend growth. But is the space too hot?

1.9% to 2.4% Industrial REIT Dividends

We’ll start out with the blue chips of the industrial real estate space, which all have a few things in common:

- They’re some of the biggest industrial REITs on the market.

- They’re some of the best performers of the past few years.

- They have provided decent to good dividend growth over the past few years.

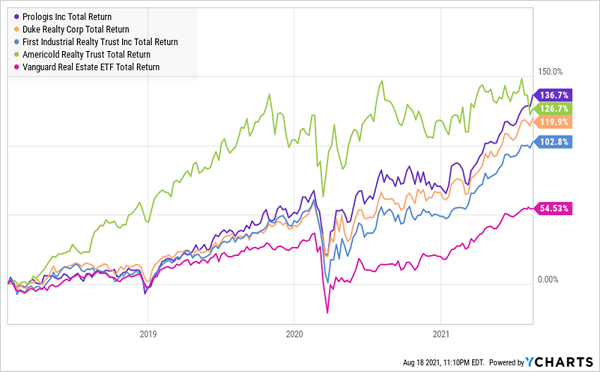

Here Are Your Leaders

The powerhouse of the group is Prologis (PLD, 1.9% yield), which serves 5,500 customers across 19 countries via a network of 4,715 logistics facilities spanning nearly 1 billion square feet collectively.

Its top 10 customers offer a few different ways to hitch a ride on the e-commerce trend. Amazon.com ranks among Prologis’ top customers, which is right on the nose. So is Home Depot (HD)—a more “traditional” retailer that nonetheless has gone digital over the past decade and requires a more robust distribution network.

And then there are United Parcel Service (UPS), FedEx (FDX), XPO Logistics (XPO) and DHL, demonstrating how industrial REITs can not only serve the sellers, but also the parcel transporters carrying goods across the country.

Other big names in the group? Duke Realty (DRE, 2.0% yield), the largest pure-play U.S. logistics REIT, boasting facilities in 20 major markets countrywide. First Industrial Realty Trust (FR, 2.0% yield)—a former Hidden Yields pick that we sold for a nice gain—is another large U.S.-centric REIT with 440 buildings serving roughly 1,000 customers from coast to coast.

Let’s also include Americold Realty Trust (COLD, 2.4% yield) in this group. It’s a specialist, dealing primarily with cold-storage warehouses and supply-chain management, which makes it essential to food transportation. But it’s a nearly $10 billon REIT that puts it among the industry’s juggernauts. Also, like many industrial REITs, Americold doesn’t just store goods and eventually toss them into trucks—it provides value-added services such as point-of-sale packaging, air and water tempering, and meat boxing.

All of these are what I would consider “safe” plays that won’t lose us money. But their prices are working against us at current levels. The average forward-looking P/AFFO (price to adjusted funds from operations, an important REIT profitability metric) for this industry sits at around 21. This foursome ranges anywhere between 27 and 34. Combine that with below-average yields (the REIT sector average is around 3%), and we’re relying on sheer growth to do a lot of the heavy lifting.

3.3% to 3.8% Industrial REIT Dividends

The balance starts to shift a little bit as we find yields closer to the 3%-4% range.

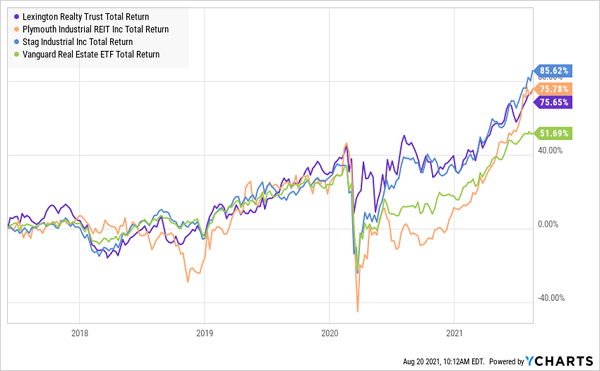

Middle of the Pack

Better current income is a plus. So are more reasonable valuations. But performance has been more moderate, and we really start to see some warts.

Take Lexington Realty Trust (LXP, 3.3% yield). This mid-cap U.S. REIT claims 136 properties across 38 states, and it is nearing the end of a fairly rapid transition from a blend of roughly 50% industrial, 50% office/other real estate to a predominantly industrial portfolio.

It has outperformed the REIT sector by a few percentage points over the past five years or so, but it has done so with a much smaller dividend than it used to offer. LXP had to cut its payout by 42% in 2018, to 10.25 cents per share, to aid in the repositioning. The dividend is back on the rise, but by only 5% total over the past two years. The stock trades at 19.2 times AFFO estimates—under the industry median, but only by a little.

Plymouth Industrial REIT (PLYM, 3.7%), which owns 178 buildings in 12 U.S. markets, is the cheapest of this bunch, at 16.1 times forward AFFO estimates. It’s also the smallest, at just $743 million. But there are income concerns here, too, as PLYM was one of the few industrial REITs to hack away at its dividend during COVID. It cut its payout by about 47% to 20 cents per share last year; it brought that payout up to 21 cents in July.

Stag Industrial (STAG, 3.5%) is a single-tenant-focused industrial REIT that trades at a forward P/AFFOs in the low 20s—not absurdly priced, but not a discount, either. Dividend growth has been glacial, though Stag is a rare monthly dividend payer. That’s a bonus.

4.9% to 5.9% Industrial REIT Dividends

Are they bargains, or are they just cheap?

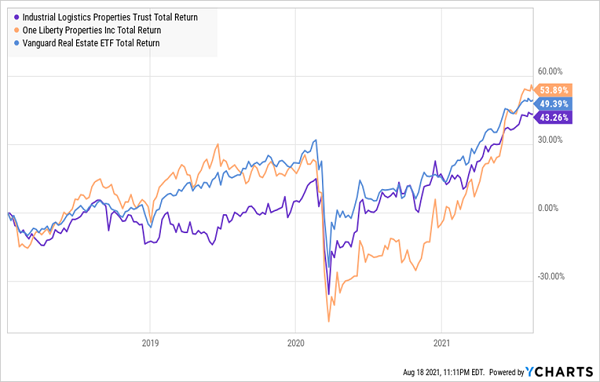

Bringing Up the Rear

Industrial Logistics Properties Trust (ILPT, 4.9%) and One Liberty Properties (OLP, 5.9%) both trade for forward P/AFFO ratios in the teens. So the price is right. They also both offer some of the juiciest dividends in this slice of the market…

… but that’s mostly a function of price. Neither REIT has raised its payout in years.

One Liberty is a wild card, largely because it’s not a pure-play industrial REIT. Only 55% of contractual rental income comes from logistics plays; the rest of the portfolio includes retail, restaurant, health & fitness, theater and other tenants. So none of us should be surprised to learn that OLP has been dealing with tenant credit issues well into this year, as well as relatively low liquidity.

Industrial Logistics Properties Trust, on the other hand…

ILPT boasts 35.2 million square feet across 291 properties in roughly 30 states, with a focus on the Midwest. Plains and East Coast. And perhaps it’s this relatively low profile, and mediocre share performance, that has shares running under the radar. Because operations look great right now. Its most recent quarterly FFO beat estimates, rent renewals saw average rental rates jump by nearly 18%, and occupancy is a stellar 99%.

Will Your Nest Egg Survive the 50-Year Retirement Storm?

It’s a rare value in the space, and it should enjoy a multiyear tailwind as e-commerce continues to gobble up retail market share.

But the question you have to ask yourself before buying ILPT: Is this the kind of stock that can help you weather a once-in-a-generation storm?

I’m not talking about hurricanes or floods. I’m talking about an inflationary storm that could sweep away the savings of unprepared investors.

But for those who know the proper way to position themselves? Well … the last time something like this happened, I turned a modest $2,000 investment into $154,000 in just 48 months.

Here’s what we’re up against:

For the last two decades, the Federal Reserve has kept interest rates under 2% for the vast majority of the time … and pegged them near ZERO for roughly one third of that time. That starves any investor looking to earn reasonable returns without taking big risks!

But what’s really terrifying is that the Fed’s unstoppable printing press is just the beginning of the “50-Year Retirement Storm” I’m warning my readers about.

So, how do we keep our savings from going underwater?

We have to throw out the dated 1970s playbook that first-level investors tend to cling to when inflation fears intensify. Our modern “2021-style” inflation is more likely to rhyme with 2009.

That means we need to do three things:

- Own stocks to stay ahead of the curve.

- Avoid companies that are going to drown when the economy reopens.

- Identify inflation-friendly dividends that will not only survive, but thrive, in this bizarre battle of high money creation versus low velocity.

Let me show you how I’m making my own preparations. Click here and I’ll explain my favorite dividend stocks and funds for profiting from this coming retirement storm.

Recent Comments