A big “thank you” to the 1,358 subscribers who attended our How to Bank 20% Returns (Plus Sky-High Yields!) in 2020 with Safe Dividend Stocks webcast last Wednesday! We had a lively question and answer session. I love the enthusiasm!

Let’s use our time together today to review some of the questions that kept popping up.

Q: In terms of expected returns, what is the difference between your Contrarian Income Report, Hidden Yields and new Dividend Swing Trader strategies?

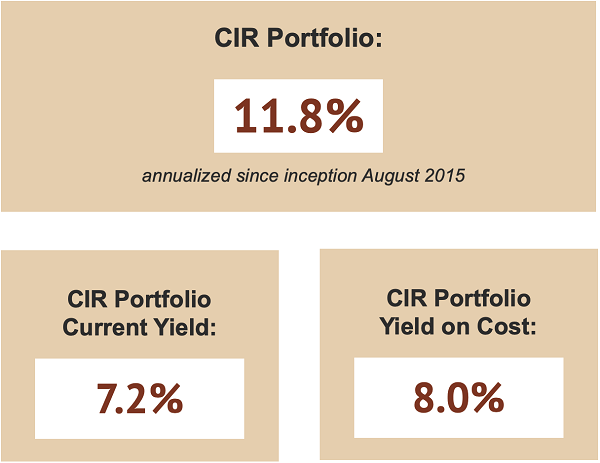

Our Contrarian Income Report service is designed to maximize the income you receive from your portfolio today. In CIR, we’re fattening up your monthly and quarterly dividend checks as much as we can without sacrificing principal. (And as you know, we prefer to grow principal, too!)

Since inception, CIR has returned 11.8% per year including dividends:

Hidden Yields, meanwhile, trades yield today for payout (and price) growth tomorrow. The stocks in our HY portfolio are increasing their dividends at a rapid clip (by about 14% annually on average), and their stock prices are rising at a similar pace.

Since inception, HY has returned more than 18% per year. Sure, it has benefited from a bull market, but I do expect the strategy to continue to return 15% or more per year over the long haul.

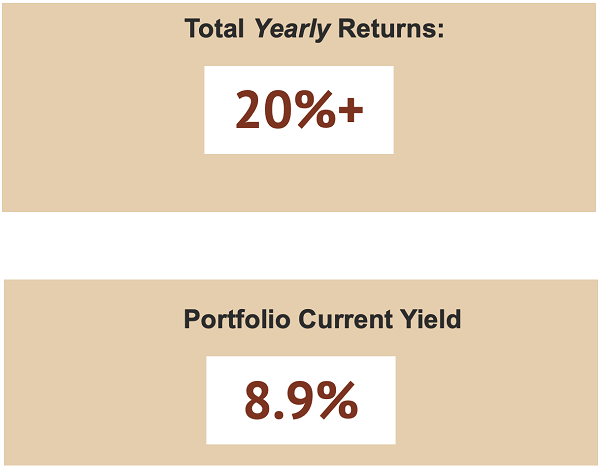

Meanwhile my new service, Dividend Swing Trader, has the most near-term upside. In DST we are targeting 20%+ total returns. A generous 8.9% current yield gets us off to a flying start. From there, I am cherry picking our purchases so that we catch the meat of a major move up in the stocks and funds that we buy.

DST Return Targets and Current Yield

Q: Will Dividend Swing Trader hold any of the positions that CIR currently holds?

No. I’ve been lobbying my publisher for more than a year to let me run a service like DST because I want to expand the number of stocks and funds I’m able to recommend.

CIR has gathered quite the following, with more than 15,000+ paid subscribers. I am grateful for your support. And part of not taking you for granted is making sure I can get all of my subscribers in and out of positions at favorable prices.

With a large subscriber base, this becomes increasingly challenging. I don’t mind the extra work (as you can tell, I love what I do), but my job does add a “math problem” layer regarding the enthusiasm our subscribers have for our picks.

Again, it’s a great “problem” to have. I’ve helped run and write income newsletters with 75,000+ subscribers that weren’t this active in aggregate! It simply means I must also think like a money manager.

So, instead of ruling out funds with modest amounts of assets under management and stocks with smaller trading volumes, I prefer to keep these “in play” for subscribers who are interested in a more active approach. Hence, Dividend Swing Trader.

Q: How will you modify your investing approach in a “down trending” environment?

I developed DST for the manic markets we have to work with today. The big dividends we’re buying help provide a “floor” under the stocks and funds we buy. (Hence, DST is the safest trading service you’re likely to ever see.)

Plus, we can make sure we stay on the “right side” of current financial trends. For example, I wrote about a “Never Go Down” dividend portfolio in my May 30, 2019 column. Earlier that month, I’d fielded questions from subscribers who were looking for dividend plays that’d never drop. So instead of lecturing them about patience, I figured it’d be a fun time to take my DST research public.

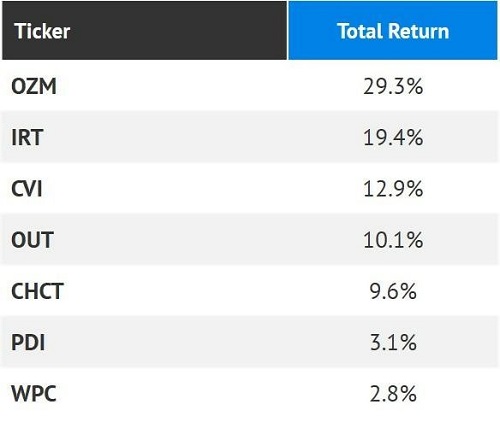

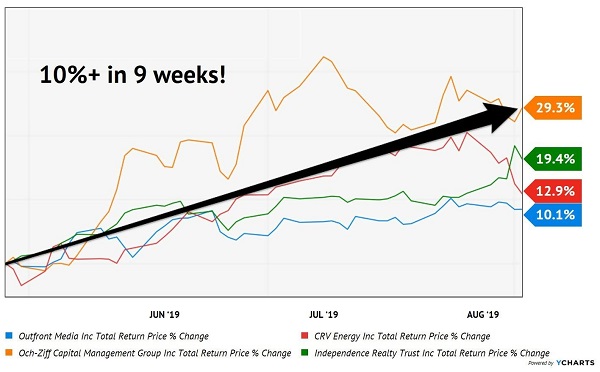

The portfolio was a 7-pack that paid 6%. And it simply rolled higher in the two months that followed!

“Never Go Down” Picks (9 Week Returns)

These stocks had two characteristics in common. First, they had favorable fundamentals. Cash flows could cover their payouts, and many firms were set up for dividend raises in the future (which would further boost their shares through any market environment.)

Second, these stocks were all “acting well.” The May ‘19 bloodbath was beginning to subside (reminding everyone that even bull markets have scary pullbacks), and these stocks sailed through the turmoil. It was a hint that, if and when markets turned around, these stocks would really move higher.

And move higher they did, with four of the seven stocks returning more than 10% in just 9 weeks!

Dividend Swing Trader, Take 1

Q: How many open positions do you expect in DST?

Ten. We have four positions in the portfolio today, and one more on the way tomorrow.

We’re going to hold these stocks and funds for months, potentially many months, and sell them when their uptrends run out of steam. We’ll then book our profits and put our money into the next dividend plays ready to run.

Q: Are you going to be recommending stocks, CEFs or both in your DST portfolio?

Both. As I write we have a 50/50 split between stocks and CEFs.

Eventually, I expect we’ll skew higher in terms of stocks. But I like the flexibility to recommend either, as this wide “dividend mandate” helps us play any market, bull or bear.

Q: Are you still offering your options trading service?

No. Dividend Swing Trader is replacing my work with Options Income Alert. (As I mentioned to a subscriber on last week’s webcast, I have a five-year-old and a two-year-old at home. I am not looking to add to my current workload!)

OIA had a good run, with an 18.8% average return per trade since inception. But the put selling strategy has a few unfixable flaws that I prefer to do without.

First, it’s complex. I mean, what a grind for subscribers! To sell puts for meaningful income, you have to target “expiration dates” that are nearby. Which means you need to sell puts early and often and repeat the process regularly. We were selling puts every week. I frequently heard from subscribers who wanted a simpler way to bank 20% per year.

DST is easier. Buy a few stocks now, watch ‘em go up, and sell ‘em in a few months when I say so. Then do it again. Simple buying, holding and selling versus options.

Second, options cap your upside but open up your downside. The most you can ever gain, when selling puts, is the premium you collect up front. From there, only “bad things” can happen (for example, the stock can go down and you can be put the shares at a loss.)

In DST were are “uncapping” our upside. We’re buying shares and letting our winners run. As you’ve seen, it is possible for dividend stocks and funds to return 100% or more. We want these profits in their entirety!

Also, the dividends prop up the price of the stock or fund. Again, this is probably the safest trading strategy you could draw up thanks to the presence of big payouts. As we know, you can’t keep a good dividend stock down.

Have you signed up for Dividend Swing Trader yet? If not, why not?

We are wrapping up our risk-free trial offer as we speak. And between you and me, its price may never be this low ever again. As I alluded to earlier, we are capping our subscriber count for DST so that we can take advantage of opportunities in smaller stocks and funds (which is where many of the fun inefficiencies can be found, even in 2020.)

If you are even remotely interested in this strategy, I’d grab your risk-free trial right now. My publisher had originally planned to leave the offer open through the end of the month, but I do worry that the instant popularity of DST is going to force them to reduce that timeframe. As I write the offer is still open, and you can take advantage of it (and set yourself up for 20% returns in 2020) right here.

Recent Comments