There’s a quiet shift happening in the market, and we’re going to tap it for some big, and growing, dividends, plus serious price upside, too.

Here’s what I mean: after tech ran the show all of last year, fanboy (and -girl) faves like Apple (AAPL), Microsoft (MSFT) and Tesla (TSLA) are cooling off, and other corners of the market are making a play for the lead role.

Big Tech Rolls Over …

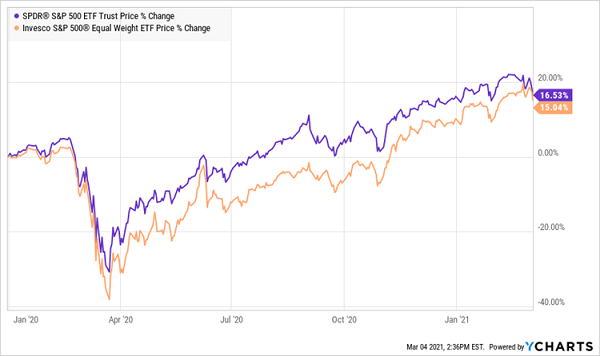

Here’s more proof that a big shift is underway: all through last year, the S&P 500 as a whole powered higher. But if your portfolio is properly diversified, you know that this gain was a mirage. Strip out Big Tech and the market’s showing was less impressive.

But that’s changing. A quick look at the S&P 500, both as-is (in purple below) and equal weighted (in orange) shows this clearly.

… And the Rally Broadens (and Powers Up)

Overall, this new, broader-based run is a positive sign for the bull market’s health. Our job is to figure out where to put our cash to grab the biggest gains (and dividends).

And no, we’re not going to play whack-a-mole trying to pick winning sectors. That’s what first-level investors do, and it’s why they always underperform. Instead, we’re only going to apply three simple rules to set ourselves up for further gains—and healthy dividends—in the months ahead:

- Sideline tech and front-run the first-level crowd as they roll into other sectors;

- Buy top-quality stocks that have been left behind—meaning they haven’t yet bounced back to their pre-pandemic highs, and …

- Grab stocks with high, and ideally growing, dividends—because a rising payout builds up the yield on our original buy; it also acts like a magnet on a stock’s share price.

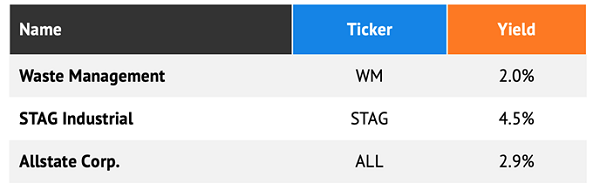

Let’s dive into three names that should be on your watch list now. All tick each box on our three-point checklist, and one even pays you a dividend every month.

Waste Management: A Trash-Powered Dividend That’s Soaring

Waste Management (WM) is a smart play on both the new Biden stimulus plan—which you no doubt know includes $1,400 checks for taxpayers—and the massive cash hoard locked-down consumers are sitting on: in December, the average household saved 14% of disposable income, nearly double pre-pandemic levels.

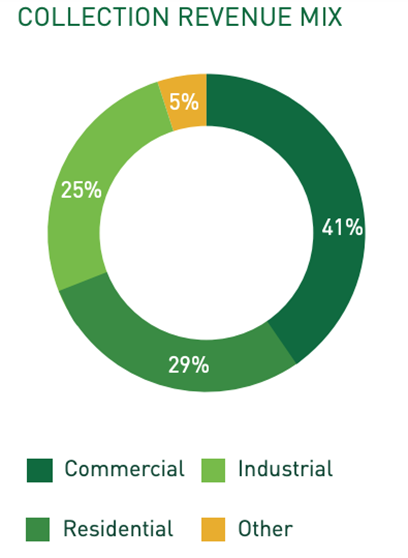

Waste Management collects garbage and recyclables and operates landfills across the country, serving around 20 million customers. As consumers restart their spending, they’ll buy a lot of goods with a lot of packaging—and Waste Management turns that trash into cash.

The stock also gets us in on more than just a consumer rebound: the firm’s operations are nicely spread across commercial and industrial customers, too:

Source: Waste Management investor relations

Waste Management started 2021 from a strong base: despite the pandemic, it generated $2.7 billion of free cash flow (FCF, or the cash left after management pays the bills and funds expansion) in 2020, up from $2.1 billion in 2019.

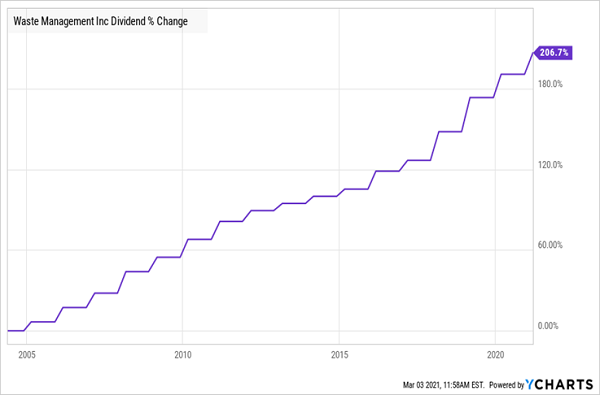

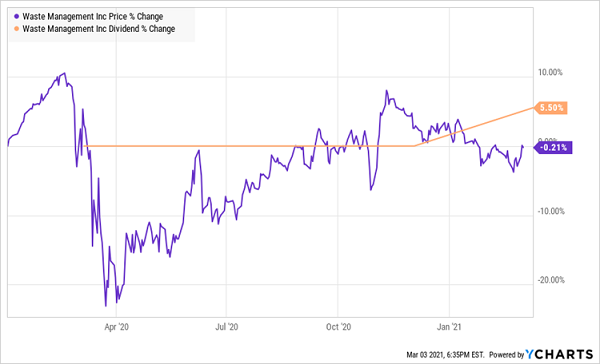

That rising cash tide will, in turn, fuel Waste Management’s dividend, which grows no matter how much of a mess the broader economy is in: its workmanlike payout rolled higher through the 2008/’09 mess and the 2020 meltdown:

A Textbook “All-Weather” Dividend

Yet despite these advantages, Waste Management still trades well below its pre-pandemic peak, even though management recently rolled out a nice 5.5% dividend hike. (That gap between the dividend and the share price is our upside, by the way, as rising dividends attract more investors who, in turn, push up share prices.)

Waste Management Is (Unfairly) Left in the Dust

It’s only a matter of time before the stock retakes its old high and, once it breaks through, rises from there. The time between now and then is, in my view, short.

STAG Industrial: A Disrespected E-Commerce Play

STAG Industrial (STAG) isn’t a tech stock, but it gives us a piece of a corner of the tech market that will grow no matter how many more lockdowns we see: e-commerce.

The real estate investment trust (REIT) owns warehouses, and Amazon.com (AMZN) is its top tenant. Other e-commerce beneficiaries, like FedEx (FDX) and XPO Logistics (XPO), also rent space from STAG, as do other firms that will benefit from an economic bounce-back, like Ford Motor Company (F) and Costco Wholesale (COST).

STAG is known for paying dividends monthly, as opposed to quarterly. And while it’s not known for dividend growth—the payout has only risen about 20% in the last eight years—you do get an attractive 4.5% yield, triple what the average S&P 500 stock pays.

Three other strengths make STAG a nice play for this bull run:

- Its payout accounts for 76% of funds from operations (FFO, the best measure of REIT profitability), which is very sustainable for STAG, with its steady rental income and 97% occupancy rate.

- It’s attractively priced, at 16.8-times FFO, and,

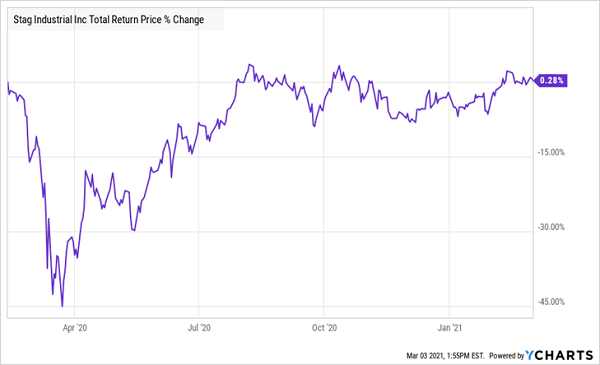

- While the stock has climbed back its pre-pandemic high, that happened very recently, and you need to go by STAG’s total return—including its big dividend—to get it over the line.

STAG Hits a Key Level of Support—and Sets Up to Rise Further

The bottom line? We’ve got a nice setup for STAG, as its warehouses supply the badly needed retail therapy consumers are about to embark on.

Allstate: A Smart Play on Rising Rates

Long-term interest rates took a breather after the 10-year Treasury yield broke through 1.5%, up sharply from 0.9% in January. But now that it’s well above the psychological 1% barrier, I expect it to soar further yet.

That’s good news for Allstate Corp. (ALL), which saw its costs drop in 2020 as lockdowns parked cars across the country, slashing claims at its auto-insurance business. That drove the company’s underwriting profit higher: in 2020, Allstate was able to keep 21 cents on every dollar of the premiums it collected after it paid its claims and its own administrative expenses, way up from 15 cents in 2019.

That amounted to an excellent “combined ratio” of 79.1. The company also benefits as long-term rates rise because insurers invest the premiums they collect in, among other things, government and corporate bonds. And yields on those bonds rise with Treasury yields.

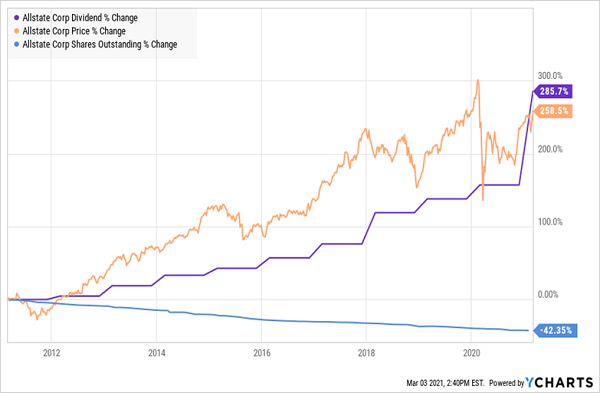

Allstate also does a terrific job of handing its profits to investors, both through share buybacks (it’s repurchased 42% of its shares in the last decade) and a surging dividend, including the huge 50% payout increase the company announced on February 23. Both of those moves are helping drive the stock price higher:

Allstate Pays Us 3 Ways

Yet despite all that, Allstate is still well off its 2020 high, as you can see above. And when you add in the firm’s bargain forward P/E ratio of just 9, the opportunity here becomes clearer still.

My Top 7 Buys for SAFE Double-Digit Gains in the Next 12 Months

The market’s rotation away from tech plays right into the hands of my 7 top dividend-growth stocks to buy now. These breakthrough picks are perfectly positioned to:

- Predictably double or triple your investment every few years.

- Protect your portfolio from wild swings so you can enjoy a stress-free, secure retirement.

- Let you hold them for years without the “can’t sleep at night” worries you’ve no doubt been living with over the past 12 months.

Now is the time to buy in, before these 7 stocks’ prices race away from us. Don’t miss out. Get full details—names, tickers, complete dividend histories, best-buy prices and more—on all 7 of these stout dividend growers now.

Recent Comments