How Low is Dollar Sentiment?

Not as low as I expected, according to an ad hoc reader survey we conducted this week.

Earlier in the week, I read that the percentage of dollar bulls was reported to be under 10%, indicating that the dollar may be setup for another long, powerful rally – with sentiment readings resembling those recorded at previous dollar bottoms.

So, I decided to conduct a little experiment, and asked readers if they were bullish or bearish on the dollar – here are the results:

- 44% dollar bulls

- 56% dollar bears

Incoming results had a slightly bearish slant throughout the voting period. What can we conclude? Possibly that:

A – Dollar sentiments is not as bearish as believed

B – Many of our readers are contrarian in nature

C – Some combination of A and B

Care to weigh in on this topic before we turn it over to the final arbiter, the market? Please do!

The Art of Contrary Thinking

A few weeks ago my wife sent me to a used book store to attempt to sell back some old books at our place. While browsing the investing section (of course), I came across The Art of Contrary Thinking – a book written in 1954 by Humphrey B. Neill.

Neill was editor of Neill Letters of Contrary Opinion, a newsletter that reviewed investment themes and ideas that were contrary to public sentiment. So being an “aspiring contrarian” myself, I had to pick up a copy! (My wife rolled her eyes when I brought it in the door…)

It was an entertaining, insightful, and fast read – I’d recommend it. There is one part in particular I’d like to share.

Let me start by saying that I’ve come to enjoy reading old books, because they reflect the sentiment of the day. I now prefer reading books that are “dated”, and thus not tainted with the biases of today – I’d rather experience the biases of yesterday!

Regular readers know that I’m a flip flopper when it comes to the inflation/deflation debate. I previously believed we were destined for inflation/hyperinflation – and recently changed my outlook when I realized that EVERYONE believed just about the same thing!

Even if that view is correct – it will be very difficult to make money off of “deflation now, inflation soon” – because it’s already priced into the market.

Many inflationists become quite livid when you suggest the possibility that inflation could take longer than most believe. The common belief is that inflation is baked in the cards, because Ben Bernanke and Co are determined not to repeat the “mistakes” of The Great Depression. Thus, they will err on the side of caution, which will result in high inflation, possibly hyperinflation.

For some historical context, I’m going to quote Neill on page 59…and remember, these words were written in 1954:

It seems evident that the psychology of inflation is fully as important to study as the economic factors.

In the early 1930’s when former President Roosevelt took us off the free gold standard and commenced to experiment with a different price for gold each morning, printing presses commenced to hum with books and pamphlets pertaining to inflation. Any modern bibliography on inflation contains numerous articles and pamphlets dated in the 1930’s. We were all warned time and again that inflation would soon overtake us and ruin us. Yet a contrary psychology prevailed.

The public went serenely on its way, paying little heed to the dreaded fears and maintaining confidence in the dollar. The fact the dollar had been clipped in gold value meant nothing to the average person. The paper dollar in his pocket was still good. That was all he cared about. Result: no ruinous inflation. Indeed, dollars remained dormant. Turnover of money remained quiet. Inflation did not “take”.

Is it possible that a contrary psychology prevails again – with the average person more worried about paying down their debts, which are denominated in dollars, than the price of gold? Perhaps.

I’ve learned that contrary thinking is not about figuring out common wisdom and doing the opposite. Rather, it’s about considering ALL possible scenarios in your thought process – no matter how outlandish they may sound!

Again, the book was a great read. And we’ll continue to increase our focus on public sentiment, because I’m really starting to believe it’s something that most investors do not rely upon nearly enough (myself especially included!)

Interview with Leading Investment Blogger, MarketFolly

This week we started a fun back and forth interview with Jay from MarketFolly. For those of you not familiar with MarketFolly – please go there now! It’s an excellent site for tracking the latest holdings and insights of the greatest investors in the world.

Here’s our interview with Jay about his investing strategy, and the complimentary piece where he grilled me a little bit. Part II will be out this week.

CBM: Jay, can you give us a little background about your investment philosophy?

MF: My investment philosophy is really a hybrid of multiple styles but it really comes down to just long/short equity. Firstly, I like to focus on macro/secular themes. Then, I like to drilldown the fundamentals of whatever the sector/industry may be that I’m looking at for the ‘why’.

Quick Market Hits for the Week Ahead

- HUGE oil inventories were reported last week…could this be setting the stage for a crash in the price of oil?

- Foreign investment in the US is going down, down, down…how exactly are we going to fund this multi-trillion dollar deficit?

- Taxes on stripper poles??? How’s a girl supposed to make a living these days?

- Jim Rogers AND Marc Faber say they would not be buying Chinese shares right now…anyone buying China now must believe they are smarter than these two.

- Think Natural Gas is cheap? You might think again after reading this analysis.

- How did Intel report such good results? We got the inside scoop…direct from an Intel senior executive!

- Finally, for the novice – and veteran – trader, here are the three things you need to do to trade markets properly.

Daily Updates

For our weekly subscribers – we now have a daily subscription option as well (check out the upper left corner of the page).

It’s powered by Google – they send you one email each afternoon, with a wrap up of posts from the day. They do a nice job with it – so if you’d like to add a daily subscription, you can enter your email address in the box there.

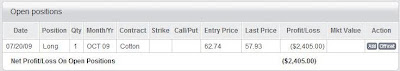

Positions Update

Still long cotton…

I’m considering shorting the S&P if/when the next wave down hits. Doesn’t look like we’re there just yet…public sentiment is bullish, but not quite wild enough to indicate a top.

Shorting oil may also be a potential play…though every commodity analyst on the planet seems to concur that oil is overpriced with respect to fundamentals right now.

Current Account Value: $25,088.91

Cashed out: $20,000.00

Total value: $45,088.91

Weekly return: 1.1%

2009 YTD return: -50.6% (Ouch, that’s gonna leave a mark)

Prior year’s results: –> Don’t try this at home…this is what is known as wreckless trading

2007: 175%

2006: 60%

2005: 805%

Initial stake: $2,000.00

Recent Comments