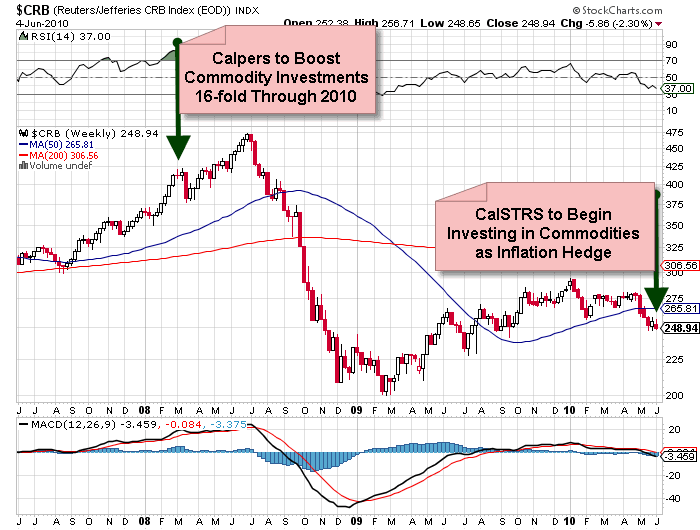

Contrarian indicators don’t get much better than this.

Our good friend here in town, fellow Austrian economist fanatic Jonathan Lederer sent along word today that the California State Teachers’ Retirement System (CalSTRS), has approved a plan to begin investing in commodities “as a hedge against inflation and to buffer losses in equities” (Seriously, I’m not making this up – Source: Bloomberg).

CalSTRS is the second largest public pension fund in the US. It’s nice to see them hopping on the reflation trade 15 months into the rally – and particularly AFTER commodities placed a major top back in January.

I couldn’t help shake the feeling of deja vu…hadn’t we seen this before? And when I checked – yes, as a matter of fact, we have.

In February of 2008 – Calpers, the California Public Employees’ Retirement System (and the largest public pension fund in the US) announced it’s intention to increase it’s exposure to commodities 16-fold:

“Strength in commodity markets will be something we should see generally over the next 10 to 20 years,” CIO Russell Read, 44, said in an interview in April, a year after he moved to Calpers from Deutsche Asset Management. “The actual importance of the energy and materials sector we believe is going to explode.”

Sounds like a pretty astute call from Read – how’d it work out?

Looking to time market tops for commodities? You needn’t look any farther than Calpers and CalSTRS.

It’s very fitting and, quite frankly, beautifully poetic, that the bureaucrats running the second largest public pension fund in the US are going long commodities right after they formed a secondary top.

“Gradually investing in commodities now will give us time to prepare for spikes in inflation,” Carrie Lo, an investment officer at the pension fund, told the board today.

Sounds reasonable. How’d that type of logic work out recently?

Calstrs, as the Sacramento-based fund is known, lost 25 percent in the fiscal year that ended June 30, led by a 43 percent drop in its real-estate holdings and a 28 percent decline in its private-equity investments, according to a statement last year.

Public pension funds, and governments in general, are quite often the ultimate herd when it comes to investing. You can almost be sure that when the suits as Calpers and CalSTRS are looking at getting “into commodities”, you’ll probably make out quite well taking the other side of the trade!

Recent Comments