I’ve zeroed in on five real estate investment trusts (REITs) set to hand you three critical things in 2019:

- High, safe payouts whose yields crush the typical S&P 500 dividend.

- Booming dividend growth: These five have already boosted their payouts an amazing 38%, on average, in the last five years—and they’re just getting started!

- Double-digit upside as an overlooked market shift kicks in, sending investors scrambling into these ironclad income plays.

Why am I so confident?

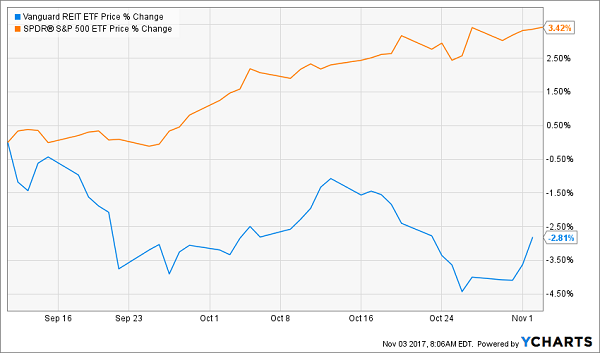

Because a long-running (and needless) worry that’s shackled REITs through 2018 has just been cast aside—but most folks are only starting to sense this big shift.… Read more

Recent Comments