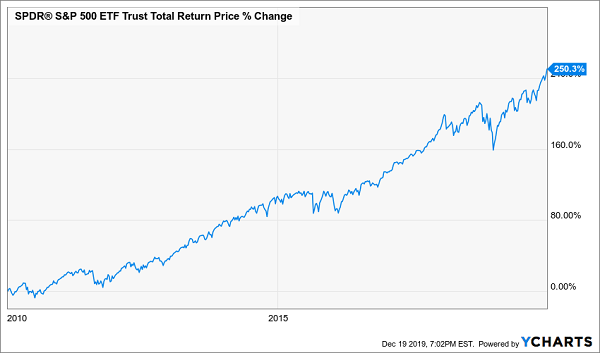

Until a flu-like virus emerged halfway around the world, it’s been three peaceful months since we’d seen a “1% up or down day” in stocks. As usual, the volatility inspired investors to reflect upon the advanced age (almost eleven years) of our current bull market.

To paraphrase the legendary rock band Chicago, does anybody really know what time it is in the rally right now? “Late cycle” is a popular guess. But how late?

Did the streetlights just pop on, or is it 2am with money managers stumbling into their taxis and Ubers outside?

Most rallies don’t make it to eleven, but then again, most don’t follow financial crises either.… Read more

Recent Comments