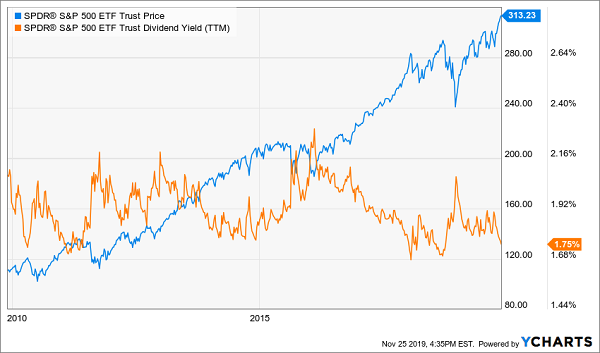

Imagine investing a million dollars and getting back … a pathetic $19,000 in income every year.

You don’t have to imagine—because that’s exactly what you’d get if you bought the typical S&P 500 stock today, which yields a sad 1.9%. That’s not much and these days, you can lose that in one afternoon!

No wonder dividends get no respect!

But I’ve got good news: that 1.9% doesn’t matter a bit to us. In fact, it’s a distraction from the real opportunity I want to show you: a dead-simple, 3-step shot at a much bigger payout.

I’m talking about 6%+ in cash here.… Read more

Recent Comments