Let’s not fall in love with our dividend stocks—as this can be a big mistake in a dumpster-fire year like 2022. We must be ready to toss “paper” payer tigers out and move into safe dividends poised to “front run” the next big market shift.

(I’ve got three tickers that are smart plays to swing into now, with yields up to 8.4% and payouts that have surged up to 55% in the last five years, taking their share prices along for the ride.)

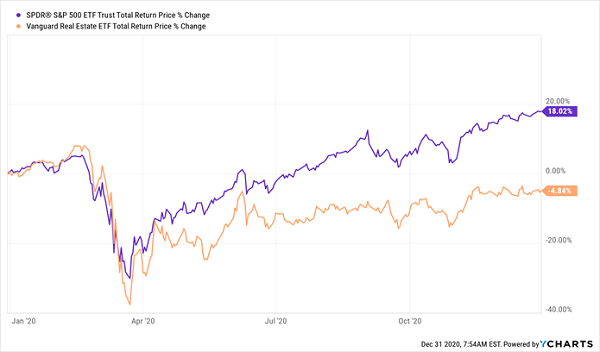

“Buy-and-Hopers” Get Crushed

Before we go further, let’s take a moment to keep “buy and hold” investors in our thoughts—or as I like to call them, “buy and hope” investors, who sit tight for years, usually in an index fund, hoping for gains.… Read more

Recent Comments