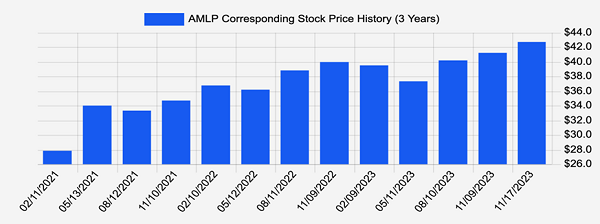

A 7.7% payer we watch very closely just did something weird for a stock with such a high payout: it hiked its dividend—for the 29th straight year!

Most folks will tell you a 7.7% payer with a dividend that consistently grows is a myth at best—or a “yield trap” at worst. But these hikes are just another mark on the calendar for this company’s investors.

Its latest hike—and forecast of more of the same in 2024—came out in a press release from the company late last week. The firm is a little-known (at least here in the US) natural gas shipper.… Read more

Recent Comments