Let’s jump into the Kraft-Heinz (KHC) mess—because it tells us a lot about how to protect our nest egg from a Dumpster fire just like it in the future.

“Dumpster fire” is no exaggeration. KHC (which investors tend to buy for safety, remember) cratered 31% in a day on February 22, after slashing its dividend 36%. Imagine what that would have done to your retirement portfolio (and hopefully you only have to imagine!).

Further on, we’ll smoke out three stocks (including one that pays an absurd 12.9% dividend) that could easily be the next Kraft-Heinz. If you hold them, the time to sell is now.

A Storm We Saw Coming

If you’ve been following my articles, you know I’ve been warning about KHC for a long time, most recently at the end of November 2018.

So I wasn’t surprised when it reported a backbreaking $12.6-billion loss for the fourth quarter—in large part due to a writedown on the value of its wilting brands—and adjusted earnings per share well below expectations.

That huge writedown sets up my first dividend warning sign. (You’ll see as we move through these that, like any disaster you read about in the history books, the red flags are connected and get more dire as calamity draws nearer.)

Dividend Warning Sign No. 1: The Industry Zigs; Your Stock Zags

You always want to be on the lookout for shifts in a company’s industry, and a management team that just can’t turn the ship in time.

This was our first warning sign for KHC—and it was obvious for more than a decade.

I’m talking about the move to healthier eating: today, Ipsos tells us that 55% of Americans usually opt for a wholesome option when they hit their favorite restaurant or buy groceries.

The result? Organic and local-food sales are soaring, with the former surging 6.4% in 2017, according to the latest numbers from the Organic Trade Association.

How far off the track was KHC? Its sales fell 1% in 2017!

Things look no better now. Look at the laundry list of yesterday’s classics management is stuck with:

KHC’s Brand Museum

Source: kraftheinzcompany.com

Which brings us to our next red flag…

Dividend Warning Sign No. 2: Stalled Sales Growth

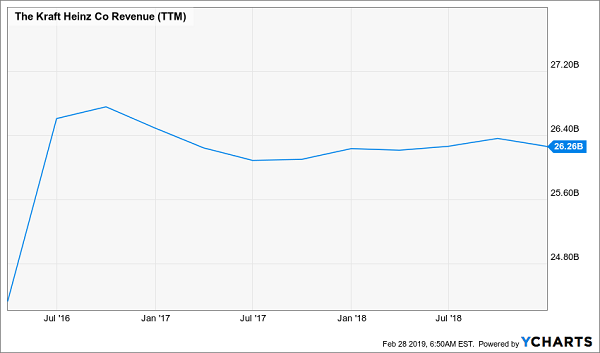

Sales drive earnings and free cash flow (FCF), which, in turn, drive dividends. And you can see that KHC’s sales have been drifting downward for two and a half years.

Sales Fail to Launch

This chart only shows trailing-twelve-month sales until the end of September 2018, but the fourth quarter brought no improvement, with revenue for the year clocking in the same, at $26.26 billion.

My next indicator is the most telling sign a dividend is in trouble.

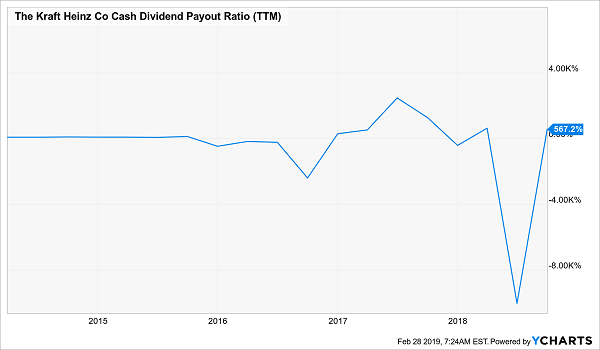

Dividend Warning Sign No. 3: A Perilous Payout Ratio

The payout ratio is the percentage of net income a dividend has eaten up in the last 12 months. But I prefer to use FCF, rather than net income, as it’s less prone to accounting manipulation. For stocks like KHC, I demand a ratio of 50% or less, no matter if we’re talking net income or FCF.

And as you can see below, as of the end of the third quarter, KHC had been posting either a negative FCF payout ratio (meaning it’s been paying out dividends while generating negative FCF) or paying out far more in dividends than it’s generating in cash flow:

A Dividend Red Alert

Cue my last red flag …

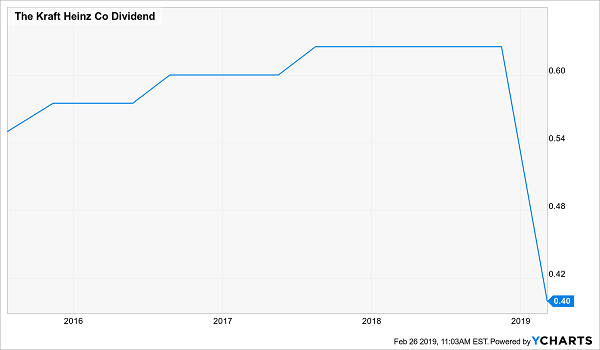

Dividend Warning Sign No. 4: A Missed Hike (and a Deceptive Dividend Yield)

Since Kraft and Heinz merged in 2015, KHC had raised its dividend yearly, usually in August (even though these increases were modest—the last one was just 4%).

Last August? Not a peep:

“Radio Silence” Foretells Dividend Chop

The bottom line: when a stock you own regularly hikes its dividend and then slows—or stops—those increases, it’s time to pay extra attention.

Now, just before I reveal our next three worrisome dividends, let me take on the elephant in the room: the fact that KHC’s dividend yield has been on a sugar high for years:

KHC Masquerades as an Income Powerhouse

But bear in mind that current yield is calculated by dividing the yearly payout into the share price.

So in other words, KHC’s soaring yield was a danger sign disguised as a benefit. Let’s add its share price to the above chart to get the full picture:

Diving Share Price—Not Rising Payout—Fueled This Yield

This shows that you need to look beyond first-level indicators like dividend yield—to sales, FCF and the payout ratio—to get a clear picture of dividend safety.

Now let’s wrap up with …

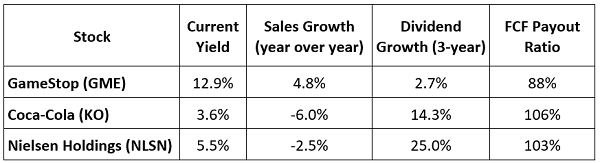

Three Dividends That Could Be the Next Kraft-Heinz

Let’s start by putting our three laggards to the same test we ran KHC through, looking at FCF payout ratio, sales growth and dividend growth.

Off the bat, we see that two of our three have negative sales growth over the past year, with one, Coca-Cola (KO), reporting a mammoth 6% drop as it battles the same shift in consumer tastes as KHC.

And don’t be fooled by that 12.9% yield at GameStop (GME). As with KHC, it stems from a falling share price, particularly after GME shed nearly a third of its value on January 29, after management said it was no longer trying to sell the company.

The Real Reason for GameStop’s 12.9% Dividend

GME is the Blockbuster of video games, and it’s at real risk of running out of lives as gamers go online to get their fix.

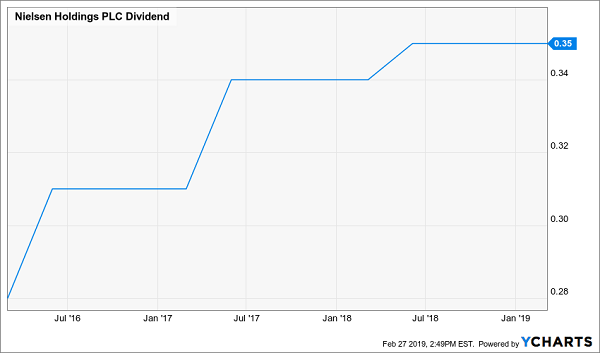

Finally, a word on Nielsen Holdings (NLSN), whose 25% dividend growth over the past three years might tempt you to dive in. But almost all of that hike came early in that span—Nielsen’s payout growth is slowing:

Nielsen’s Decelerating Dividend

Dangerous dividends like these are why I developed my “8% Monthly Payer Portfolio.” As the name says, it hands you an outsized 8% payout (or $40,000 in income on a $500K nest egg), enough for many folks to retire on dividends alone.

8%+ Payouts Delivered to You Every Single Month

And also as the name says, you get your dividend checks monthly—so you don’t have to wait three long months for your next payout.

Dependable monthly payouts give you two critical advantages:

- Your payments come in with your bills. No more stumbling about trying to manage a “lumpy” quarterly income stream, and …

- You can reinvest your cash faster—amping up your gains and your dividends, too.

“Sure, Brett,” you’re probably thinking, “but how can I be sure this income stream is safe?

Well, I’ve got you covered there, too. Because the stocks in this exclusive portfolio come from across the economy and from the strongest income sectors, like real estate investment trusts (REITs), closed-end funds (CEFs) and preferred shares.

And there’s more …

Your Personal Dividend Monitoring Service

These stout monthly dividend buys come your way when you “kick the tires” on my Contrarian Income Report service with no risk and no obligation.

When you join, you get an extra benefit the poor folks who went over the cliff with KHC only wish they had: my dividend-monitoring service.

Much like the security alarm on your house, I’ll keep a watchful eye on all the stocks in the “8% Monthly Payer Portfolio.” If one trips any of my dividend-danger alerts, I’ll issue a sell call right away.

You just can’t get better payout safety than that.

Recent Comments