What will 2018 hold for income investors?

Well, it depends where you look. Buying pricey blue chips for 2% or 2.5% yields looks like a crowded, low upside trade. Same with most mainstream bonds, which don’t pay much more.

But – thanks to a lack of attention from “first-level” financial websites – there are some bargains still worth buying in 2018. I’m talking about dividends of 8% or more, with extra price appreciation potential to boot.

What are these best buys? And how are they possible in this 2% world?

First Let’s Thank Fed Fears, Which Are Probably Overblown (Again)

This time last year, I told you that Fed rate hikes wouldn’t affect us income investors in 2017. Except for providing us contrarians with chances to fade overrated worries, of course.

That’s exactly what happened. My favorite closed-end funds (CEFs) crushed the broader market last year while also paying triple to even quadruple the dividends:

These 6%+ Payers Paid Up to 39% 2017

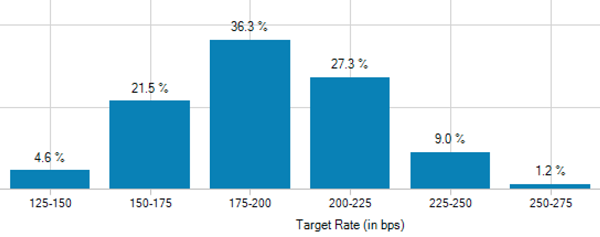

Select CEFs are well positioned to continue winning in 2018. A new Fed chief may be on the way, but the “smart money” is betting on only two more rate hikes in the next twelve months:

The Smart Money Bets 2 Hikes in 2018

The Fed’s easy money policy should continue. But it doesn’t really matter if we see one rate hike or two (or even three) this year.

A savvy closed-end manager can borrow cheaply and juice returns by earning more than the cost of borrowing. CEFs borrow at rates tied to Libor (the London interbank offered rate). That’s good living today with that international benchmark in the basement (still around 1.6%). That’s a pretty low hurdle for a CEF manager to clear.

Libor is tied closely to the Fed funds rate. So, the worrying goes, higher Fed rates will end the “cheap money” party that benefits CEFs.

Many of the funds I like the best use 20% to 33% leverage. It’s a “no brainer” boost to our payout when they can earn a safe 6% or so for us and turn that into 8%. If that leverage became too costly, our funds would be forced to cut back on their debt (and their distributions).

But how costly is too costly?

It’s more than most armchair analysts think. And rates are unlikely to get to these “breaking point” levels for CEFs. We’ve been investing on this income thesis for almost three years now, and we’ve been spot on thus far.

How did we predict the future? We simply looked at the past. By doing so, we saw that during the last rate hike cycle, prominent CEFs did just fine. Heck, they even outperformed the S&P 500 (blue line below) itself!

Last Rate Hike Cycle, CEFs Rolled Higher

For some perspective, then-Fed chairman Alan Greenspan took the Fed Funds rate from 1% to 5.25% in two years. That was a real-life stress test for CEFs.

So we have plenty of runway to continue buying CEFs and banking their dividends. And even if I’m wrong about rates staying relatively low for another long while, we have plenty of time (years to decades) to monitor and re-evaluate (if and when the Fed ever hits 5% again).

Regular readers will recognize the Greenspan example quite well, because I’ve been using it repeatedly to drive this point home. And I’m glad to share another data point – our own profits from this rate hike cycle!

The chart below illustrates the three CEFs I mentioned rolling higher in lockstep with the Fed Funds rate (and that rate is the orange line stair stepping from the lower left to the upper right):

This Rate Hike Cycle, Our CEFs Have Rolled Higher

These three CEFs have gained in the face of rate rises. But we don’t want to blindly chase past performance, of course. We want to figure out which funds will not only pay their 8% dividends in 2018, but also identify those with price upside to boot.

The 3 Best Bond Buys (with 8%+ Dividends) for 2018

Most Wall Street spreadsheet jockeys say we investors can’t have both the income and safety of bonds and the upside of stocks. We have to choose, or allocate, or whatever.

They’re wrong. They don’t realize that the nine bond funds in my Contrarian Income Report portfolio have delivered average annualized returns of 23.9% (including dividends)!

My three top picks for 2018 are poised to continue the tradition. These funds are a cornerstone of my 8% “no withdrawal” retirement strategy, which lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out closed-end funds that:

- Pay 8% or better…

- Have well funded distributions…

- Trade at meaningful discounts to their NAV…

- And know how to make their shareholders money.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today I like three “blue chip” closed-end funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay 8.5%, 8.7% and even 8.9% dividends.

Plus, they trade at 10-15% discounts to their net asset value (NAV) today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch funds will simply trade flat… and we’ll still collect those fat dividends!

If you’re an investor who strives to live off dividends alone, while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my no withdrawal approach – plus I’ll share the names, tickers and buy prices of my three favorite closed-end funds for 8.5%, 8.7% and 8.9% yields.

Recent Comments