Today I want to show you one of the most ridiculously oversold funds. Not only is it absurdly cheap right now, but it also pays a 7.5% sustainable dividend.

Before I get into those big cash payouts and how they’re possible, let me first explain why this fund is such an incredible bargain today.

Imagine that you could get shares in Microsoft (MSFT), Alphabet (GOOG), Apple (AAPL) and JPMorgan Chase (JPM) for 5.4% less than the market price of all of these companies.

Wouldn’t you buy as much as you could?

Well, now you can, thanks to the Eaton Vance Enhanced Equity Income Fund (EOI).

This fund is trading for 5.4% less than the actual market value of its portfolio holdings—known as its net asset value, or NAV. This is possible because EOI is a closed-end fund (CEF), and CEFs very often trade for less than the value of the stocks and bonds they own.

And those holdings are the first reason why this fund should be high on your list.

Reason #1: A Quality Portfolio

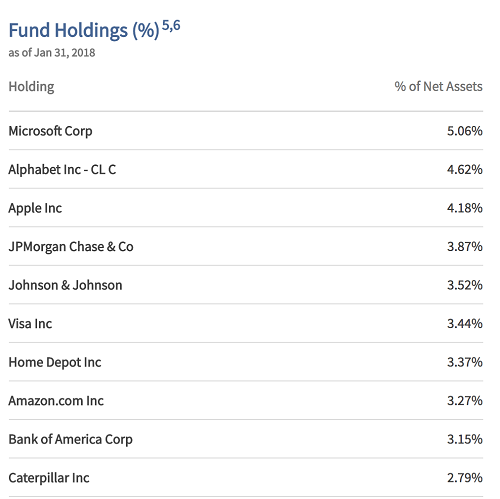

Just look at what EOI is holding—some of the safest, most profitable and fastest-growing American companies out there:

Reliable Blue Chip Stocks at a Bargain

Source: Eaton Vance Investment Managers

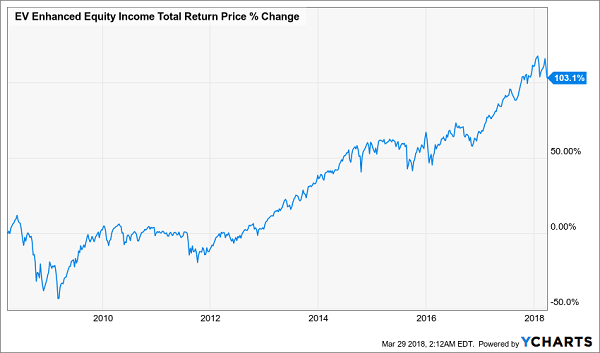

It’s that high-quality portfolio that has resulted in relatively low volatility and a strong total return over the last decade. In fact, during that time, EOI’s value has doubled:

A Strong Growth Pattern

Yet a lot of investors simply don’t know this fund exists and aren’t buying it. Why is that?

The answer is so silly, it’ll make you laugh.

Reason #2: The Market’s Big Mistake

Remember that EOI pays out a huge dividend—7.5%, in fact, which is 4 times the yield of the S&P 500. That means a lot of EOI’s return comes in the form of cash payouts delivered to your brokerage account every month, like clockwork.

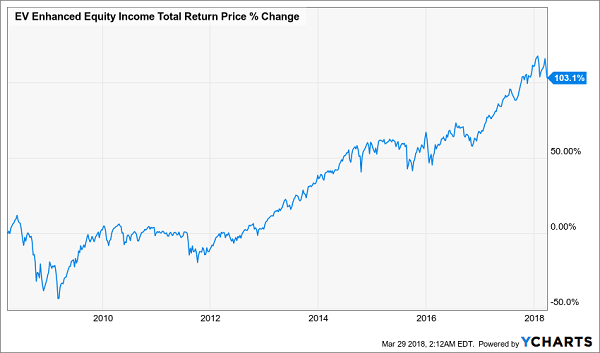

It also means that when you look up EOI’s price return, you get this:

Looks Like a Dud …

But the reason for this is that all of EOI’s gains have come in the form of cash. That’s the beauty of closed-end funds.

When we look at EOI’s total return, which includes the return from the stock price and dividends, the picture is much nicer.

… Until You See This!

Many investors simply don’t look at the total return price. And since both Google Finance and Yahoo Finance don’t offer a total return price calculation, most people don’t even know such a thing exists. And because of this silly oversight, they’re missing out on massive gains and dividends!

Reason #3: Now Is the Time to Buy

As you might have figured out by now, the goal of many CEFs is to grow an investor’s initial investment and dole out that growth in the form of cash payments every month or every quarter. That way, an investor who has $500,000 can turn that cash into a $3,125 monthly check by buying into EOI.

But why now?

Now that the market is struggling, shouldn’t we wait for more confidence in stocks before jumping in?

When dealing with buying stocks directly, I would say yes, that is a prudent course of action. But you need to think differently when investing in CEFs.

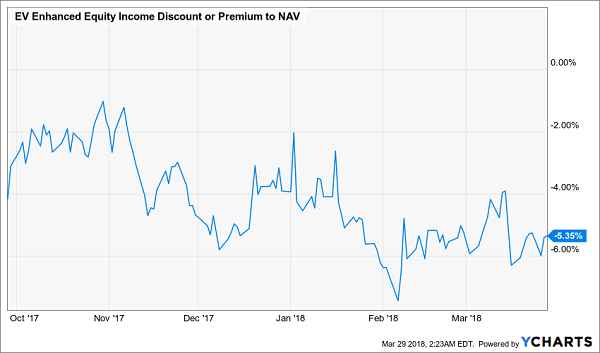

Remember the NAV I talked about earlier? Right now we’re seeing a growing disconnect between the fund’s NAV and its market price that makes EOI particularly appealing.

Since EOI focuses on S&P 500 stocks, it’s not too surprising that the fund is down 1.6% so far for 2018—which is actually better than the benchmark index fund, the SPDR S&P 500 ETF (SPY), which is down 1.9% over the same time period.

A Reality Mismatch

But notice the big gap between the orange and blue lines in the top chart above? The orange line is EOI’s NAV return and the blue line is its market price return. While the fund’s actual performance is a little better than that of the market, people are selling it off way more than they’re selling off the index fund.

In fact, investors are selling EOI at double the rate of the fund’s actual performance.

What this means is a bigger discount and more value for savvy contrarians who buy EOI now.

Discount Sale Gets Even Better

Notice how the fund’s discount to NAV has declined in recent months? That’s because of nervous investors who are overselling, making this fund particularly cheap.

Reason #4: The Outlook for Stocks is Good

But should you still be bullish on the stock market right now?

The short answer is yes.

As I recently pointed out, earnings growth is soaring, which means stocks are cheaper on a price-to-earnings (P/E) basis. On top of that, inflation is low, unemployment is collapsing and wages are soaring (I wrote about this back in February, when the correction was getting started).

We are seeing just about every positive macroeconomic indicator possible, and stocks are selling off, which means we can buy into that economic growth at a more compelling price than we’ve seen in over a year.

And while the market is selling off, why not buy what they’re overselling in a fund that is itself oversold, compounding our bargains? And while we wait for EOI to rise in price, we can collect its 7.5% dividend in the form of cash, each and every month.

4 Funds That Fit Perfectly With EOI (incredible cash payouts up to 8.1%)

EOI is a terrific buy for current income now, and there’s no doubt the fund’s overdone discount sets it up for serious gains as the herd comes to its senses.

And if you’re on the hunt for even bigger gains and upside (and who isn’t?), your timing is perfect.

Because I just gave subscribers to my paid CEF Insider service the “inside scoop” on 4 other CEFs throwing off incredible dividends up to 8.1%!

And if you think EOI is oversold, wait till you see the absurd discounts on these 4 cash machines. To cut straight to the chase, my research team and I have put each and every one through our proven CEF-rating system, and the bottom line is this:

Each of these 4 ignored funds is “locked in” for easy 20%+ price upside in the next 12 months, on top of those juicy CASH payouts!

Now I’m making these 4 funds public—but only for a limited time. Don’t miss your chance to tap these retirement-changing dividends and massive gains. CLICK HERE for the full story on these 4 funds, including their names, tickers, buy-under prices and my complete research.

Recent Comments