Don’t panic.

One week ago, Elon Musk’s SpaceX launched Falcon Heavy, catapulting the billionaire’s Tesla Roadster into space. On the dashboard were two words made famous by Douglas Adams’s Hitchhiker’s Guide to the Galaxy: “Don’t Panic.”

(Read on and I’ll tell you why you should make these two words your mantra these days; how the “smart money” is playing the selloff; and reveal the one investment you need to—calmly—sell now.)

How to Keep Your Cool When Others Lose Theirs

As Musk’s Roadster orbited above, markets on earth were freaking out.

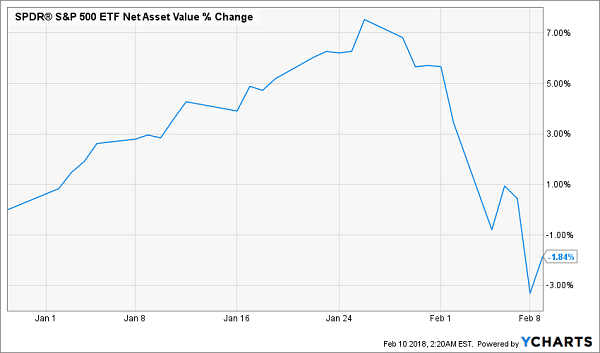

Look Out Below

In a matter of days, the 7% gains stocks racked up in less than a month were gone. At one point, the market was down 10% from its highest point for the year.

How can you not panic at a time like that?

The sudden selloff had plenty of folks wondering if they should start cashing out their 401ks and IRAs. That also happened in late 2008 and early 2009. Sellers who jumped out then did so as the market did this:

A Real Bear Market

…and were sitting in cash when the market did this:

You Want Cash … Now?

The timeline is shorter today, but I fear that many investors will do the same thing. If they panic and sell when the market’s down, they’ll lock in their losses. If they ignore the short-term declines and stay long, they’ll benefit from the recovery.

In other words: don’t panic.

The Smart Money Weighs In

There are many indicators telling me the best move is to stay in stocks. As I wrote on February 8, earnings and employment look so strong that there’s plenty of reason to be upbeat about the market.

The smart money agrees: hedge funds have doubled down. One of the most famous hedge fund billionaires, Ray Dalio of Bridgewater Associates, which manages $119 billion, says people holding cash will “feel pretty stupid.” BlackRock CEO Larry Fink agrees, more recently saying that sitting in cash will lower returns.

Which brings me to the one “ticking time bomb” asset class this selloff has revealed. If you’re holding any of these dangerous pretenders, sell now.

The Simple Mistake That Locked in a 96% Loss

I’m talking about exchange-traded notes, or ETNs.

I’m sure you’ve heard of exchange-traded funds. There are many good ETFs out there, but I worry about ETNs, which are so often lumped in with ETFs that investors usually don’t know that they’re different.

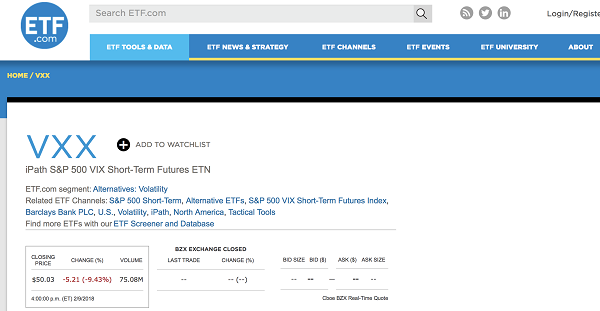

Take ETF.com, one of the most popular websites dedicated to ETFs. Except, well, it’s not. You can go on ETF.com and search for the iPath S&P 500 VIX Short-Term Futures ETN (VXX) and get a lot of data on this product.

But it’s not an ETF.

Read the Fine Print!

Source: ETF.com

Although the site is called ETF.com and the different sections are all about ETF tools and news, and we’re also told there are ETF terms related to VXX, this is not an ETF! It’s an ETN! If you see “ETN” in gray, you’ll know that this is a wolf in sheep’s clothing. But how many people will look? And how many who do will know what this means?

Not many—and that’s the problem.

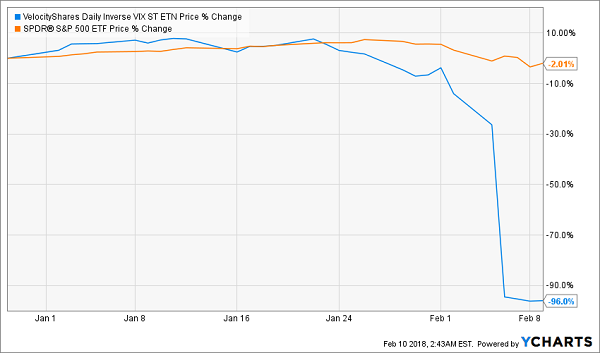

This opens the door to devastating mistakes, such as if, in this case, you bought an ETN that’s related to VXX but with one crucial difference: while both ETNs bet on the VIX, which is a measure of volatility in the S&P 500, the VelocityShares Daily Inverse VIX Short-Term ETN (XIV) is a Credit Suisse–issued ETN that bets against the VIX and was beating the S&P 500 so badly that many people bought XIV instead of an index fund.

Why Buy SPY When You Could Have This?

And this was a great idea—until it wasn’t. The chart above is from XIV’s inception in 2010 to the end of 2017. Here’s 2018’s chart:

XIV Gamble Comes Up Snake Eyes

Oh, and this is the full XIV chart, because Credit Suisse is shutting the fund down. They can do this because it’s an ETN and not an ETF, and an ETN doesn’t hold the assets it’s betting against. The ETN was a credit product—essentially, shareholders of XIV were giving Credit Suisse a loan, and the value of that loan was based on a theoretical but nonexistent basket of VIX futures the ETN didn’t actually hold.

When the VIX spiked in early February, those futures became worthless, so Credit Suisse shut the ETN down, locking in investors’ 96% losses.

Yes, they can do that—it was a clause buried in the XIV’s disclaimers. How many holders read that clause? Probably not many. Was that clause easy to find on ETF.com or other websites touting ETNs as if they’re ETFs? No.

But Don’t Panic

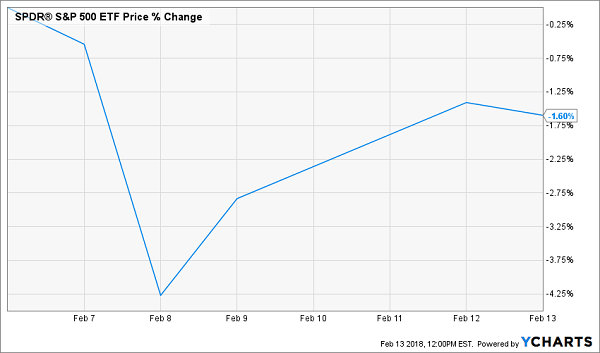

If you’ve avoided complex ETNs that are mismarketed, you’re fine. Already we’re seeing the S&P 500 recover:

The Market’s Getting Better

If you hold ETFs and avoid risky things like ETNs, you’re also fine. And your portfolio will grow in value if you’re holding ETFs that own solid, cash-producing companies.

And that’s why the best advice anyone can give you now is this: don’t panic.

4 Perfect Selloff Buys (with amazing dividends up to 10.4%!)

Here’s something else you need to know about the selloff: it’s juiced the dividends on my 4 favorite CEFs to buy now!

Take my latest addition to this esteemed list. It’s a stock fund that now throws off a SAFE 10.4% dividend! So if you drop, say, $100,000 into this cash machine, a full $10,400 would boomerang straight back into your pocket in the first year alone.

And because management has a keen eye for value (the stocks in its portfolio boast a far lower valuation than the S&P 500), it’s held up way better than the index in the market hurricane.

Shareholders of this battle-hardened fund may have wondered what all the fuss was about!

Selloff? What Selloff?

The bottom line? Thanks to its shrewd management team and rock-bottom valuation, this one has easy 20%+ upside in the next 12 months, in addition to that fat dividend yield!

That’s right—we’re looking at a 30% gain ahead by this time next year here.

These are the kinds of returns you can find when you cut emotion from your decision-making and buy when everyone else is freaking out.

I’ll show you the name of this fund right now when you click here. I’ll also reveal 3 more funds that have seen their discounts widen and their yields spike (I’m talking an 8.1% average payout), courtesy of this irrational selloff. They were great buys before … but they’re terrific buys now!

Don’t miss this unique chance to profit. CLICK HERE to get the names, ticker symbols and my complete research on these bargain CEFs now.

Recent Comments