Last week, we outlined a smart, sound retirement income strategy funded by dividends alone. Now, let’s talk growth.

We’re already well ahead of the flawed 4% fallacy – the notion that you can (or should) sell some capital every year for retirement income. With our “no withdrawal” technique, we’re already keeping our capital intact – and collecting 8% yields to boot!

Believe it or not, we can do even better with some savvy asset allocation. If you’re not yet as filthy rich as you hoped you’d be by now, don’t worry – we still have plenty of time to get you there. Here’s how.

Dedicate Some Cash to Dividend Growth

As I wrote in this month’s edition of the Contrarian Income Report, our portfolio pays 7.5% today. And I can even get you 8.3% yields on new money, by focusing on our seven best buys.

Let’s rewind back to last week’s “$1 million portfolio” example. It’s a nice round number that you can dial up or down to fit your personal situation.

A CIR subscriber with this portfolio spread amongst our positions is earning $75,000 in dividend income alone. (And no doubt urging “first-level” financial friends to ditch their underwhelming dividend aristocrats and subscribe!)

But what if this person doesn’t quite need $75,000 per year yet? If not, that’s great – we can peel off a piece of that portfolio, and grow it quickly in the meantime.

And I’m not talking about investing this “growth capital” into risky high-flying names like Tesla (TSLA) and Snap (SNAP).

We can scale our money more securely – but just as spectacularly – by purchasing sound dividend payers that happen to be growing their payouts rapidly. Here’s why.

The Most Lucrative Way Shareholders Get Paid

There are three – and only three – ways a company’s stock can pay us:

- A cash dividend.

- A dividend hike.

- By repurchasing its own shares.

Everyone loves the dividend, but investors usually don’t give enough love to the dividend hike. Not only do these raises increase the yield on your initial capital, but also they often are reflected in a price increase for the stock.

For example, if a stock pays a 3% current yield and then hikes its payout by 10%, it’s unlikely that its stock price will stagnate for long. Investors will see the new 3.3% yield, and buy more shares.

They’ll drive the price up, and the yield back down – eventually towards 3%. This is why your favorite dividend “aristocrat” – a company everyone knows and has paid dividends forever – never pays a high current yield. Its stock price rises too fast!

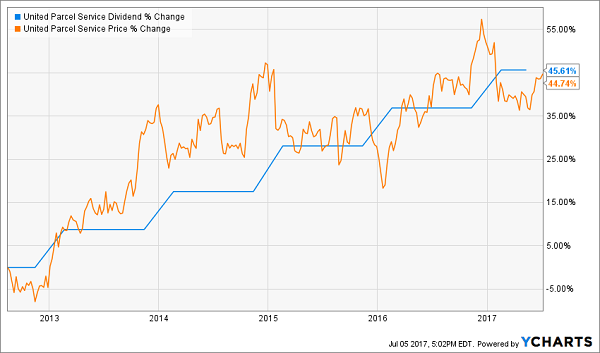

For example let’s look at UPS (UPS), which always seems to pay between 2.5% and 3%, give or take. This yield already gets you ahead of the game in today’s low rate world. Next, let’s consider the stock’s price appreciation which moves remarkably in tandem with its dividend:

UPS Payout Drives Stock Price Growth

UPS increased its dividend by 45.6% and its stock rose 44.7%. That’s no coincidence.

Boeing (BA) is an even better example. I recommended the stock to my Hidden Yields subscribers in December 2015 when its stock price (blue line) began to lag its soaring dividend (orange line). That was our cue that this stock was due to “catch up.”

That’s exactly what unfolded. We’ve nearly doubled our money (93.5% total returns) in less than two years.

Since share prices move higher with their payouts, there’s a simple way to maximize our returns: Buy the dividends that are growing the fastest.

Asset Allocation 101: Put Some Money (At Least) in Dividend Growers Like These

How much money should you allocate to dividend growth?

As you can see – as much as possible. This strategy is such a “slam dunk” for investing returns that there’s no reason to collect more current yields than you need right now. If you can “forego” some amount of income today, I would encourage you to consider investing that capital into dividend growers.

It’s a simple three-step process:

Step 1. You invest a set amount of money into one of these “hidden yield” stocks and immediately start getting regular returns on the order of 3%, 4%, or maybe more.

That alone is better than you can get from just about any other conservative investment right now.

Step 2. Over time, your dividend payments go up so you’re eventually earning 8%, 9%, or 10% a year on your original investment.

That should not only keep pace with inflation or rising interest rates, it should stay ahead of them.

Step 3. As your income is rising, other investors are also bidding up the price of your shares to keep pace with the increasing yields.

This combination of rising dividends and capital appreciation is what gives you the potential to earn 12% or more on average with almost no effort or active investing at all.

Which “hidden yield” stocks should you buy today? Well you know me – I’ve got seven best buys that should safely double your money every three to five years.

It’s a simple formula – their dividends are doubling every three to five years, which means their prices will rise in tandem. At the same time, we’ll collect their dividend payments today and enjoy an even higher income stream tomorrow.

This dividend growth strategy has produced amazing 27.1% annualized returns for my Hidden Yields subscribers since inception. In two-plus years, we’ve crushed the broader market (the S&P 500 returned 16.1% over the same time period.)

If you achieve returns of 27.1%, you’ll double your money in less than three years. So if you haven’t been following this strategy, why not? The best time to get started is right now – before the seven dividend growers I mentioned begin to move. Click here and I’ll share their names, tickers and buy prices with you right now.

Recent Comments