Environment, social and governance (ESG) investing. Socially responsible investing (SRI). Sustainable investing. These are some of the biggest investing buzzwords of the past few years, pointing to a movement by investors pushing companies to be more conscious about their impact on issues such as climate change, diversity, human rights and sustainability.

But ESG, SRI and the like are more than just buzzwords. They’re actually the principles behind several hot-performing stocks, as well as some of the more attractive dividend-yielding blue chips on Wall Street. And today, I’ll explain how some of these “do-gooder” stocks actually translate their principles into better profits, bigger share gains and fatter dividends that we can compound into retirement riches.

But first, let me show you how to screw up ESG investing.

There are literally dozens of SRI and ESG exchange-traded funds (ETFs) on the market, but one of the oldest is the iShares MSCI KLD 400 Social ETF (DSI), which at more than $1 billion in assets under management is also the largest such ETF you can buy. It invests in a simple index of roughly 400 companies that “have been screened for positive environmental, social, and governance characteristics.”

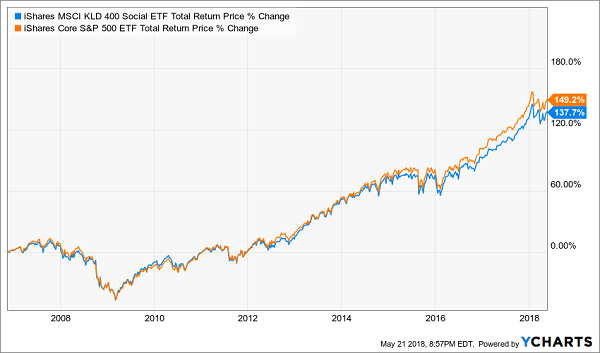

That sounds nice, but the end result is essentially just a broad large-cap growth fund that’s heavy in Microsoft (MSFT), Facebook (FB) and Alphabet (GOOGL) but has mostly tracked the S&P 500 for much of its life, and is actually sitting on lifetime underperformance on a total-return basis. Better still, even with a generous fee waiver, DSI’s 0.25% expense ratio is more than six times than what the iShares Core S&P 500 ETF (IVV) costs.

If You Pay More for Underperformance, Is It Really “Responsible”?

A few ETFs are worth their expenses, but scores of them make the cardinal sin of lumping too many losers in with too few lunkers.

My suggestion with ESG? Make precise, surgical picks whose feel-good practices come in concert with outperformance and dividend growth. Here are a few:

AbbVie (ABBV)

Dividend Yield: 3.8%

AbbVie (ABBV) is an odd bird in the dividend growth world in that it essentially “shares” Dividend Aristocrat status with Abbott Laboratories (ABT) – the healthcare company that spun off AbbVie in 2013.

Abbott Labs retained a diversified business spanning medical devices, generics and nutritional products. AbbVie essentially was the biopharmaceutical arm, responsible for treatments such as blockbuster arthritis drug Humira, hepatitis-C treatment Viekira Pak and testosterone replacement therapy AndroGel.

ABBV is also experiencing stellar growth in non-Hodgkin lymphoma treatment Imbruvica, which saw global revenues rocket 38% higher year-over-year in the company’s fiscal first quarter.

AbbVie has gained a spot in several ESG funds because of its commitment to sustainable healthcare solutions, and in fact earned the highest overall score in the Dow Jones Sustainability Index among 40 biotechnology stocks in 2017. That’s thanks in part to perfect scores in “Environmental Reporting” and “Policy Influence.”

But it also deserves a spot in dividend growth portfolios thanks to its 46-year streak of raising its annual payout. Moreover, it’s still an excellent source of potential growth, with analysts projecting 17% annual earnings growth for the next half-decade.

Starbucks (SBUX)

Dividend Yield: 2.1%

That Starbucks’ (SBUX) is an SRI stud is no secret. The company has made very public efforts on ethically purchased and responsibly produced coffee, minimizing its carbon footprint, not to mention launching a college program for its employees. The company even issued a $500 million “sustainability bond” to finance projects such as support programs for its coffee farmers.

Unfortunately, Starbucks’ shares have been decidedly decaffeinated for the past two years, delivering just 4% share growth against 30% gains for the S&P 500. But there’s reason to believe SBUX could be primed for a Grande performance.

Make that a Venti.

For one, Starbucks’ price is due to catch up to its rising dividend sooner than later. The stock’s price performance over the past decade has mostly tracked its dividend growth – exactly what we should expect out of dividend growth stocks – but shares have run out of steam lately, even though the payout certainly has not. In the past five years alone, Starbucks’ payout has burst by 130%, and continued upward pressure on the dividend should entice income investors sooner rather than later.

Starbucks (SBUX) Keeps Adding Extra Shots to Its Dividend

On top of that, Wall Street still loves Starbucks’ growth prospects, modelling 17% annual profit growth every year on average from now through 2023. A big driver of this should be the chain’s enormous China push, which includes a pledge to open 600 stores annually through 2022, at which point it should have a presence in about 100 new cities.

AvalonBay Communities (AVB)

Dividend Yield: 3.5%

AvalonBay Communities (AVB) is one of several real estate investment trusts (REITs) that have penetrated the ranks of the ESG-friendly.

AvalonBay is geographically diverse, boasting apartment communities in the Northeast, Mid-Atlantic, Pacific Northwest, and Northern and Southern California – and doing so across the Avalon, eaves by Avalon and AVA brands. As of the first quarter, AVB owned or held interest in 288 apartment communities containing 84,162 apartment homes, and also had 18 communities under construction that should contain 5,774 apartment homes when completed.

“How can a REIT be ‘responsible’?”, you ask? Well, the company itself specifically points out that operating high-density housing helps “contribute to more efficient land use patterns,” but it also ensures that its properties effectively use energy, water and other resources.

While those ESG practices help endear companies like AvalonBay to Millennials, the company itself is right in that generation’s wheelhouse. Millennials are prime tenants in AVB’s high-growth markets, and they are die-hard renters. Homeownership among people 35 and younger has dropped 18% since 2006, according to the Pew Research Center.

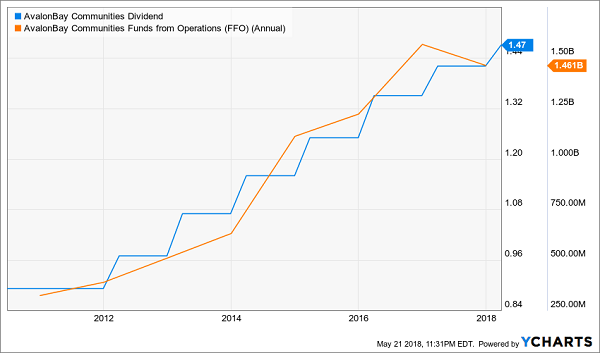

That’s helping AVB stay plenty profitable; the company grew core funds from operation (FFO) by 4.3% year-over-year for the first quarter to $2.18 per share. And AvalonBay isn’t shy about sharing its extra profits with investors. The REIT has pumped up its quarterly payout by 287% since it started paying out a regular dividend in 1994.

AvalonBay (AVB): Their Casas Are Your Cash Source

BlackRock (BLK)

Yield: 2.0%

BlackRock (BLK) is a global asset management company that offers not just branded mutual funds, but also ETFs under the popular iShares banner. And it’s doing its part to promote socially responsible investing in several ways.

For one, iShares offers legacy funds such as the aforementioned DSI. But it also has contributed to additional products, such as collaborating with JPMorgan (JPM) on a suite of ESG indices geared toward fixed-income investors. Moreover, BlackRock pivoted pretty quickly following the Parkland, Florida shootings to launch new ESG ETFs that also backed out gunmakers such as American Outdoors (AOBC) and Sturm, Ruger (RGR).

Moreover, CEO Laurence Fink has made it a point to take CEOs of publicly traded companies to task on issues such as tax reform, pressing these leaders to publicly state how they planned to use the Washington-generated windfall.

Of course, BlackRock is doing more than just pounding the ESG space. It’s one of the low-cost leaders in the ETF world, which makes it a prime beneficiary as the industry continues to swell. That’s why Wall Street’s analysts are projecting a 24% pop in profits this year, and a 15% annual average for the next five year.

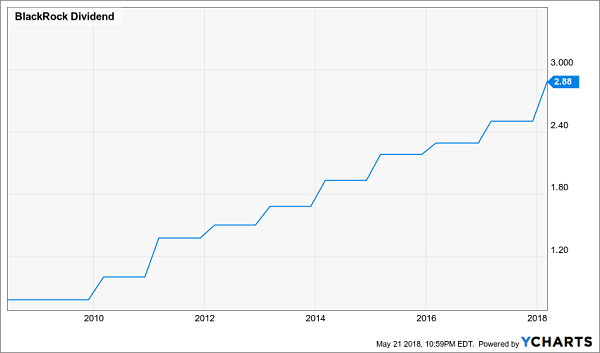

That should help fuel BlackRock’s dividend, which has exploded from $1 per share in 2004 to $10 per share last year.

BlackRock (BLK) Is iSharing the Wealth

How to Retire on 8% Dividends Paid EVERY MONTH

Relying on dividend growth from the likes of IBM will leave your retirement portfolio in tatters. In fact, even relying on Dividend Aristocrats in general could be dangerous – with an average yield of less than 2%, the Aristocrats deliver less income than the 10-year T-note!

However, I have a portfolio of dividend winners that not only will pay you 4 times more, but will pay you 3 times more often.

When you retire, chances are you’ll be relying heavily on dividend income to get you through your regular expenses: the house, the car, power … you name it. But while most publicly traded companies tend to pay dividends out quarterly, your bills sure aren’t quarterly. They come every single month, rain or shine.

That’s why monthly dividend stocks make so much sense for long-term retirement planners. A reliable stream of income that doesn’t vary from month to month allows you to budget with precision. And with the right plan, you can collect $3,000-plus in dividends every single month – and do it with a smaller nest egg than even the suits at Merrill Lynch say you need to retire well.

My “8% Monthly Payer Portfolio” checks off every box investors need from retirement:

- Monthly income to use against your monthly bills.

- Dividends large enough to allow you to live off investment income entirely. That means no selling your stocks and shrinking your nest egg, which ultimately shrinks your regular dividend paycheck.

- Better returns on any dividends you choose to reinvest. If you don’t need the income from your portfolio right away, you don’t have to wait every three months to put dividends to work – you can sink them back into new investments just about every 30 days!

These monthly dividend payers include a few picks that have remained mostly under the radar despite their high payouts and general quality. For instance, this portfolio includes an 8.7% payer trading at a bizarre 5.3% discount to NAV, and an 8.5% payer that not 1 in 1,000 people even know about.

Because these big dividends compound quicker, they’ll turbocharge your net worth and allow you to enjoy the retirement you’ve worked so dearly to reach. Don’t delay! Click here and I’ll send you my exclusive report, Monthly Dividend Superstars: 8% Yields with 10% Upside, for absolutely FREE.

Recent Comments